Amazon Should Fire Some of Its Software Engineers

We have been selling for years both in the UK and the US. We have 2 different companies for this, one in the US overseeing US sales and one in the UK for UK-generated sales. These are 2 different legal entities that import and sell merch in these countries.

We used to be able to have 2 DIFFERENT SALE OF RECORDS for different Amazon marketplaces. So we had our US company in file for amazon.com sales and UK company for amazon.co.uk. I now realize that for some unexplainable reason, Amazon merged LEGAL ENTITIES AT SELLER REGISTERED EMAIL LEVEL, meaning that one seller central sign-in email can only be assigned to 1 legal entity.

I am not sure if this is a wide-spread change or simply a software glitch affecting only our seller account. But I can confirm now that we face the following bizarre situation:

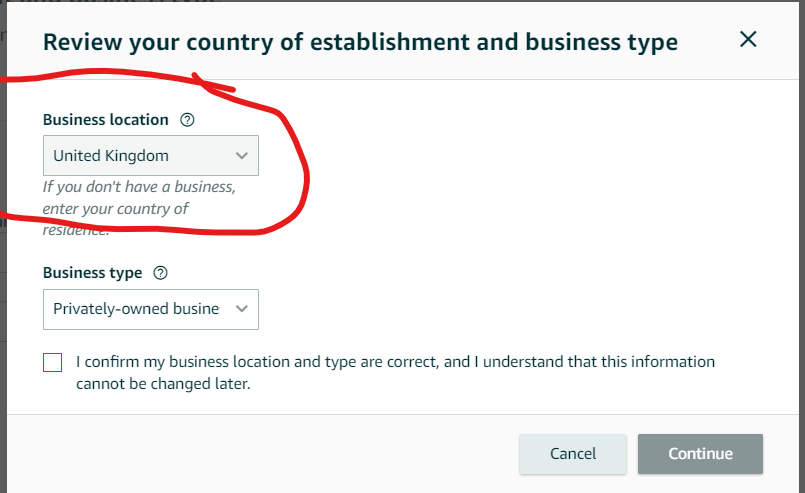

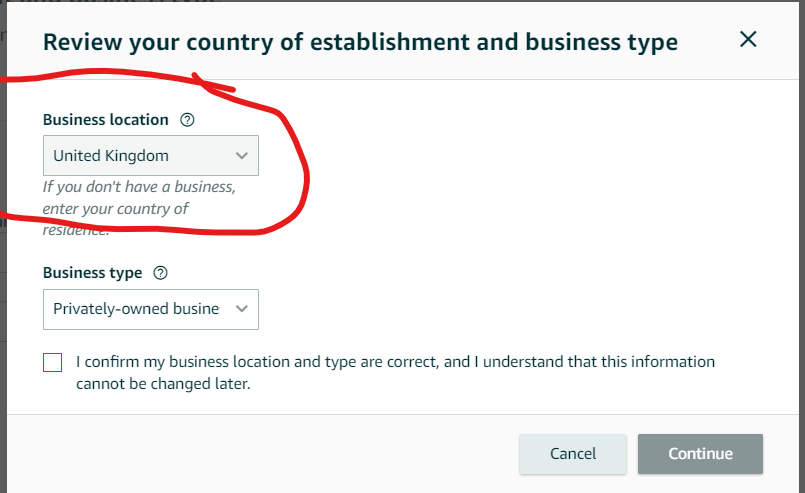

Amazon does not allow us to change the legal entity in the US marketplace to our US entity. This page used to have my US company information which is gone now! It seems that Amazon now suddenly only wants 1 legal entity for all stores worldwide. As you can see below ss, Amazon does not let me change the legal entity from our UK entity to US entity. The URL of this page has this wording: GLOBAL, suggesting that Amazon compels sellers to have 1 entity globally for all stores which is ridiculous for import and tax purposes.

We cannot use our US bank account for our US entity because Amazon no longer allows us to have our US entity as seller of record. So our US proceeds go to our UK entity which complicates everything in terms of taxation.

US Informs Act Verification Process fetches data from our UK company for our US store and we are unable to fulfill our obligation under this law which seems to lead to account deactivation at some point.

We have business insurance on file verified successfully until March 2025 for our US entity. However, as we can no longer have the US company on file, we won't be able to renew the insurance policy which is also going to lead account deactivation at some point.

Our US FBA labels in the US refer to our UK entity as our US account no longer has our US entity on file which is quite confusing for our warehouse operations.

We still can have the US company information under "Tax Information" tab and let Amazon generate 1099-K at year ends for our US which seems hard to reconcile with Amazon's above policy.

I need urgent help to address this problem and return things back to normal as usual. In particular, I need to be able to have 2 different company (seller of record) data for each marketplace/region (US and UK) as before so that I can fulfill my legal obligations such as Us Informs Act, UK VAT etc. as required.

Any idea why is this happening?

Thank you all.

Amazon Should Fire Some of Its Software Engineers

We have been selling for years both in the UK and the US. We have 2 different companies for this, one in the US overseeing US sales and one in the UK for UK-generated sales. These are 2 different legal entities that import and sell merch in these countries.

We used to be able to have 2 DIFFERENT SALE OF RECORDS for different Amazon marketplaces. So we had our US company in file for amazon.com sales and UK company for amazon.co.uk. I now realize that for some unexplainable reason, Amazon merged LEGAL ENTITIES AT SELLER REGISTERED EMAIL LEVEL, meaning that one seller central sign-in email can only be assigned to 1 legal entity.

I am not sure if this is a wide-spread change or simply a software glitch affecting only our seller account. But I can confirm now that we face the following bizarre situation:

Amazon does not allow us to change the legal entity in the US marketplace to our US entity. This page used to have my US company information which is gone now! It seems that Amazon now suddenly only wants 1 legal entity for all stores worldwide. As you can see below ss, Amazon does not let me change the legal entity from our UK entity to US entity. The URL of this page has this wording: GLOBAL, suggesting that Amazon compels sellers to have 1 entity globally for all stores which is ridiculous for import and tax purposes.

We cannot use our US bank account for our US entity because Amazon no longer allows us to have our US entity as seller of record. So our US proceeds go to our UK entity which complicates everything in terms of taxation.

US Informs Act Verification Process fetches data from our UK company for our US store and we are unable to fulfill our obligation under this law which seems to lead to account deactivation at some point.

We have business insurance on file verified successfully until March 2025 for our US entity. However, as we can no longer have the US company on file, we won't be able to renew the insurance policy which is also going to lead account deactivation at some point.

Our US FBA labels in the US refer to our UK entity as our US account no longer has our US entity on file which is quite confusing for our warehouse operations.

We still can have the US company information under "Tax Information" tab and let Amazon generate 1099-K at year ends for our US which seems hard to reconcile with Amazon's above policy.

I need urgent help to address this problem and return things back to normal as usual. In particular, I need to be able to have 2 different company (seller of record) data for each marketplace/region (US and UK) as before so that I can fulfill my legal obligations such as Us Informs Act, UK VAT etc. as required.

Any idea why is this happening?

Thank you all.

1 reply

Emet_Amazon

Hello @Seller_ZczHqytoxS9Xv,

Thank you for your post.

We are closing this duplicate thread.

Please create only one topic per question. Creating multiple threads for the same question causes confusion and disruption to the forums, potentially taking longer for you to get the answer you are seeking.

You may continue the discussion in your original topic, thank you.

Emet.