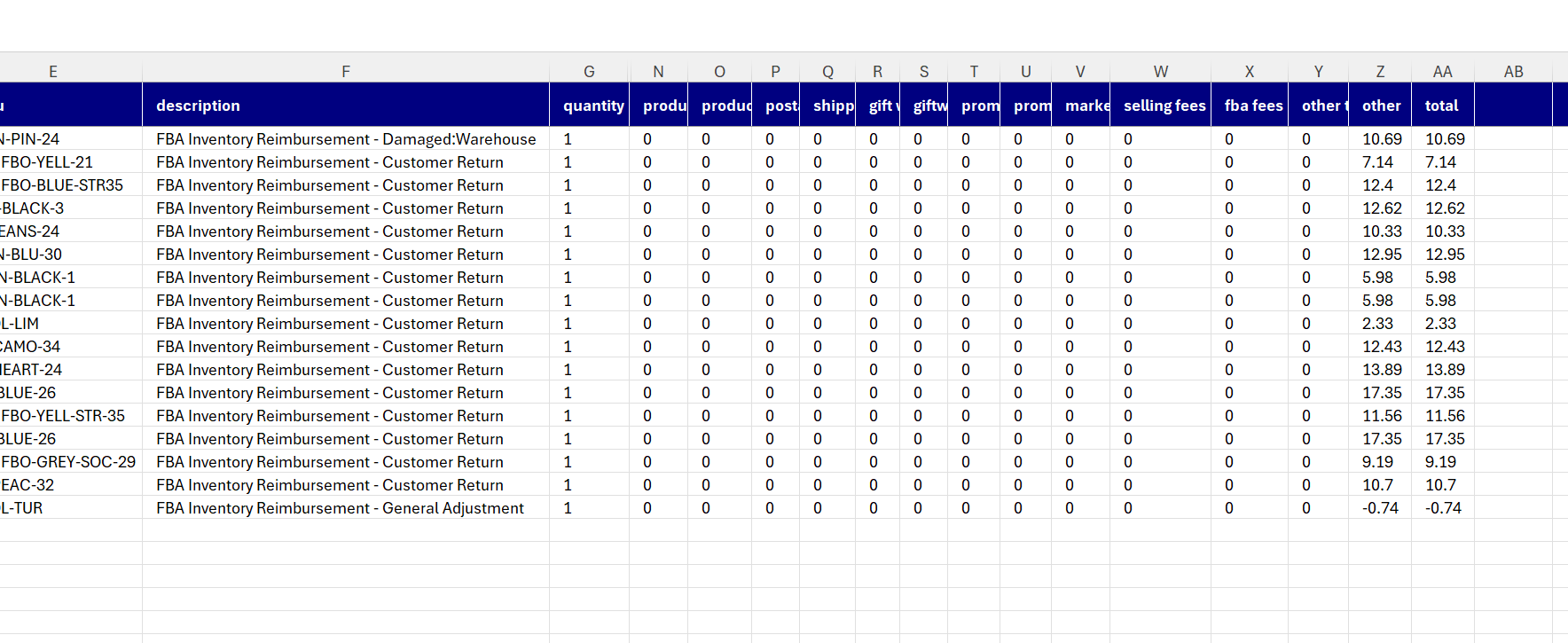

Reports Repository - Date Range Transaction Report -FBA Inventory Reimbursement - Customer Return

I believe there is error in Date Range Transaction Report in Adjustments (FBA Inventory Reimbursement - Customer Return)

When the customer buys product, he gets an invoice. He declares he wants to return, and Amazon generates the Credit Note.

For now everything OK, but if costumer doesn't return, Amazon creates FBA Inventory Reimbursement - Customer Return record. Amazon charges fees and gives the rest of the money to the seller. On this Point should be generated another VAT invoice (I cannot find it) and the VAT record should be in Adjustments (FBA Inventory Reimbursement - Customer Return).

Unfortunately, there is only total in Adjustments, which means the VAT calculations in Date Range Summary Report are wrong.

I believe there should be generated an invoice for every FBA Inventory Reimbursement - Customer Return

Not all products are 0 vat and I have to calculate VAT manually:(

Any thoughts?

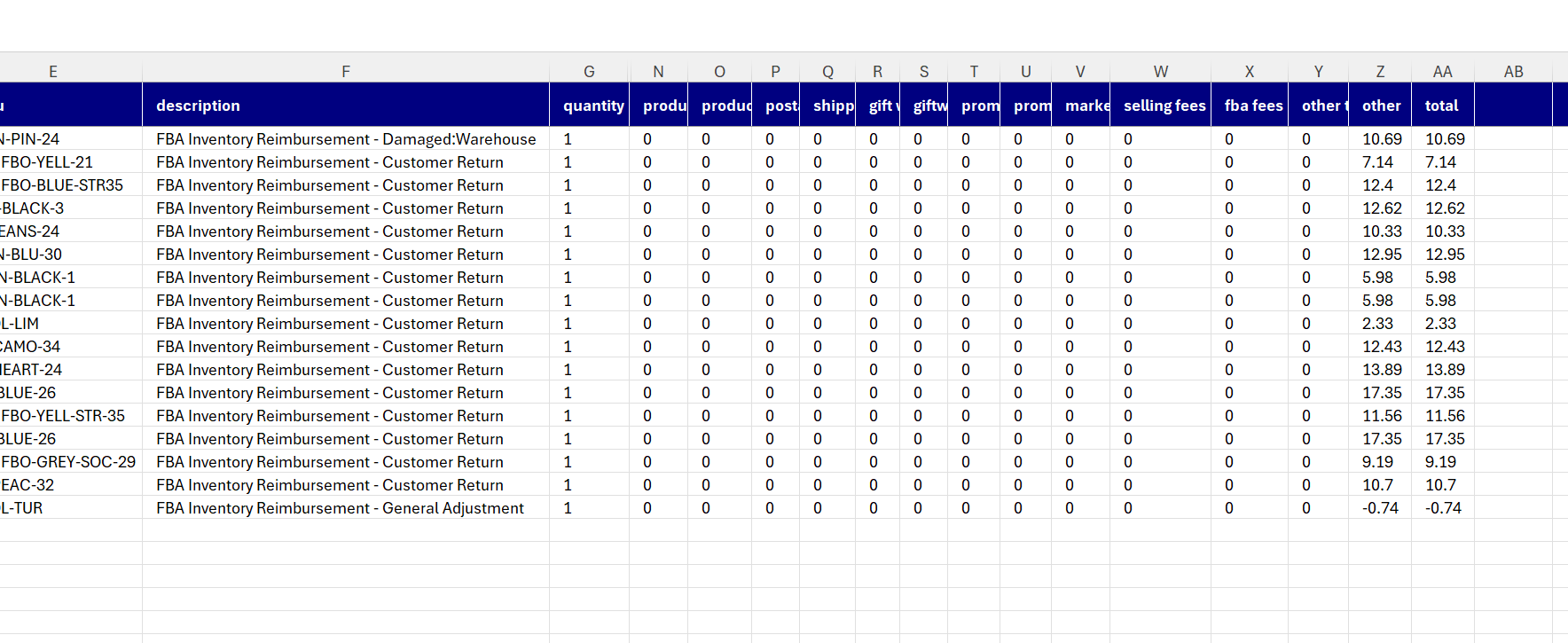

Reports Repository - Date Range Transaction Report -FBA Inventory Reimbursement - Customer Return

I believe there is error in Date Range Transaction Report in Adjustments (FBA Inventory Reimbursement - Customer Return)

When the customer buys product, he gets an invoice. He declares he wants to return, and Amazon generates the Credit Note.

For now everything OK, but if costumer doesn't return, Amazon creates FBA Inventory Reimbursement - Customer Return record. Amazon charges fees and gives the rest of the money to the seller. On this Point should be generated another VAT invoice (I cannot find it) and the VAT record should be in Adjustments (FBA Inventory Reimbursement - Customer Return).

Unfortunately, there is only total in Adjustments, which means the VAT calculations in Date Range Summary Report are wrong.

I believe there should be generated an invoice for every FBA Inventory Reimbursement - Customer Return

Not all products are 0 vat and I have to calculate VAT manually:(

Any thoughts?

1 reply

Seller_pZPUigSoKl3Mk

3 weeks now and nobody interested in correct VAT calculations?:)