Disbursements deactivated - Non-UK Resident VAT

How are we going to fix this guys? Foreign-owned Ltd companies in the UK are expected to pay ALL OF THE VAT FROM SALES SINCE 1st JANUARY 2021 or else our Disbursements remain locked. (illegal by the way!)

Seriously?

This is completely ridiculous, I have a UK company that does trade ONLY in the UK. I don't need to be a UK resident, it clearly says on the HMRC website.

I have been paying VAT like I am supposed to, and now Amazon expect me to message HMRC and say "hey, please give me all my tax back, cheers". Are you serious?

I can't even disburse my payments to pay my VAT bill, or my Corporation Tax.

Regards every foreign seller.

Disbursements deactivated - Non-UK Resident VAT

How are we going to fix this guys? Foreign-owned Ltd companies in the UK are expected to pay ALL OF THE VAT FROM SALES SINCE 1st JANUARY 2021 or else our Disbursements remain locked. (illegal by the way!)

Seriously?

This is completely ridiculous, I have a UK company that does trade ONLY in the UK. I don't need to be a UK resident, it clearly says on the HMRC website.

I have been paying VAT like I am supposed to, and now Amazon expect me to message HMRC and say "hey, please give me all my tax back, cheers". Are you serious?

I can't even disburse my payments to pay my VAT bill, or my Corporation Tax.

Regards every foreign seller.

12 replies

Seller_JPjPx9j8QbJpn

I have the same issue, can you please update.

Seller_KCgXCYrZGs5tp

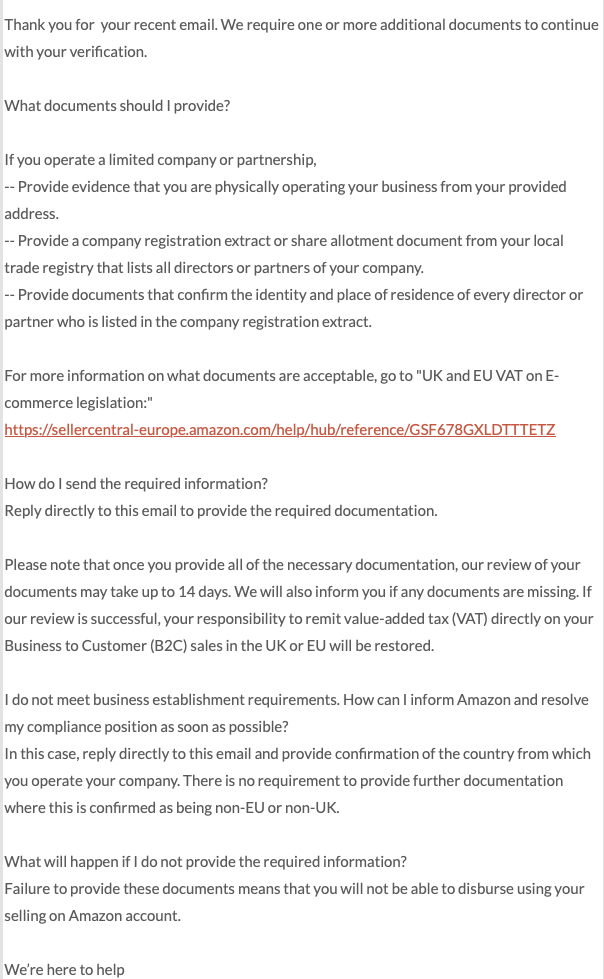

The same is the case with us. Foreign-owned Ltd company VAT registered from day 1 paying VAT regularly to the HMRC but still all these harassment with us. Even after confirming as per the notification, that we are not established in the UK. Not getting any solution from Amazon even after declaring our non-established status to Amazon by sending the email to drtax-nonestablished@amazon.co.uk below is the screenshot. As said in the screenshot I again confirmed the same and as expected got the same reply again...Please share, if anybody received a different reply or asked to submit something else...