Calculating Fees and profits

Hi

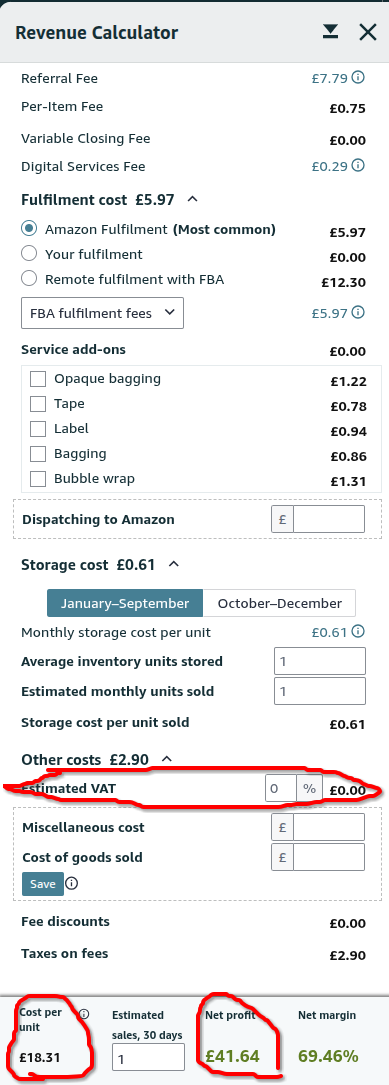

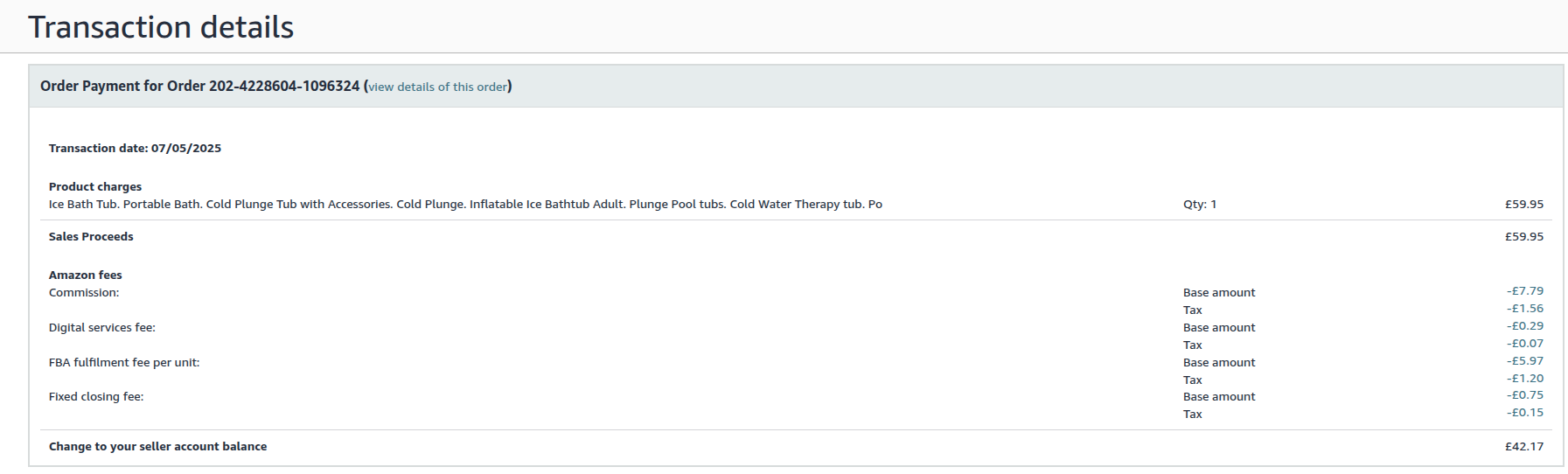

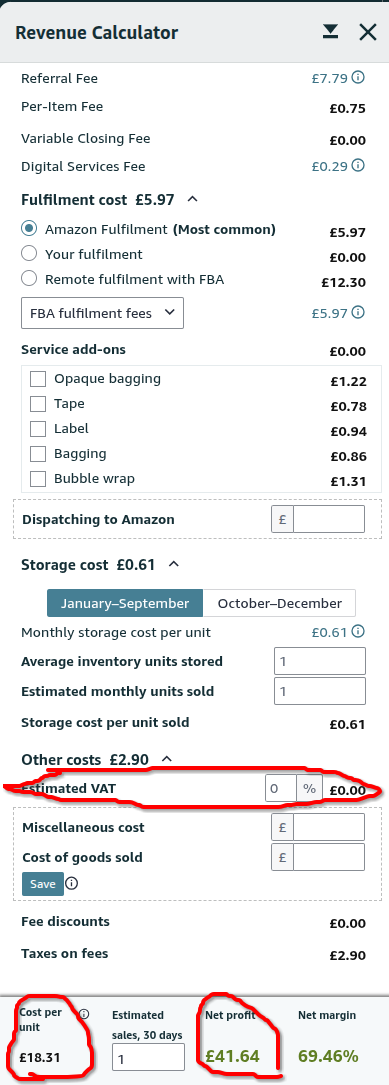

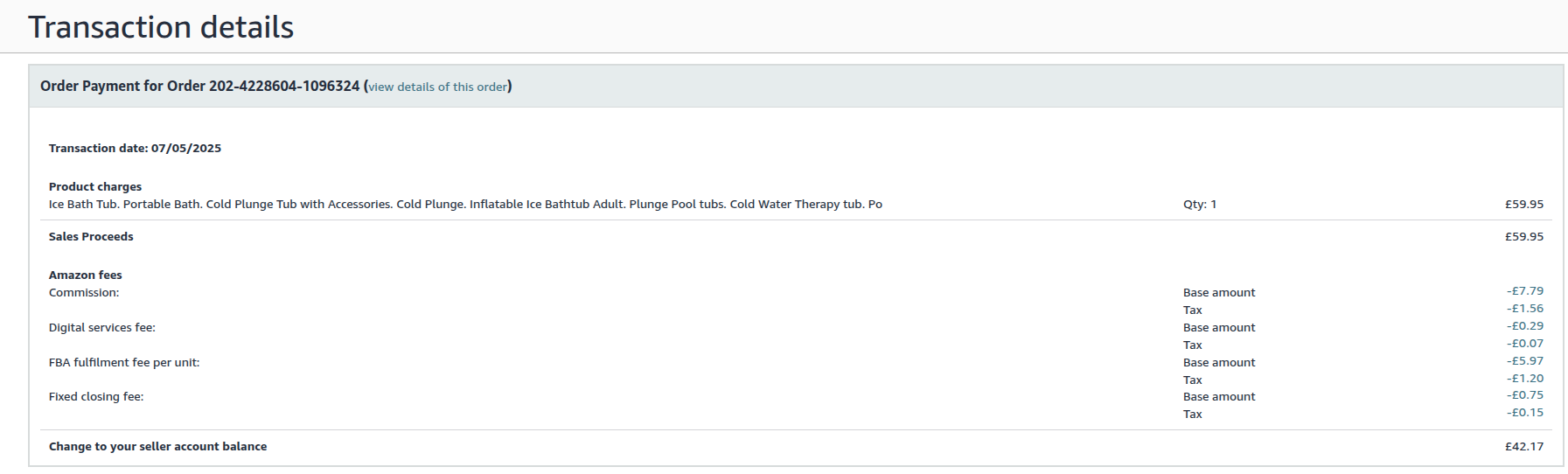

3 images are attached. The Revenue Calculator image shows, I suppose it's a best guestimate, which just about matches the final statements of the Transaction Details page.

But I have two questions:

1: In the Revenue Calculator I input zero for VAT. As the amounts seem to be correct, does that mean that the customer has paid the VAT? And where can I find invoices for each sale detailing this?

Those two were question 1, lol.

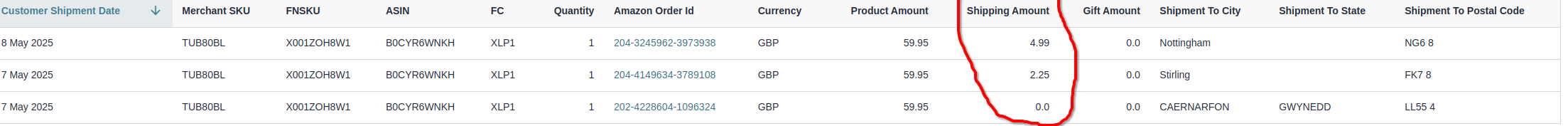

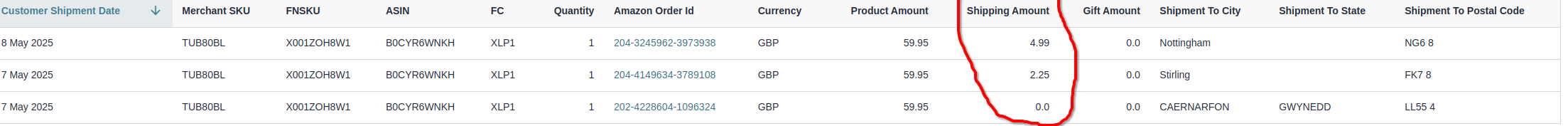

2: In the fourth image attached, Customer Shipping Sales, I have noted that some customers are paying for shipping, whilst the majority are not. Why is this, and why does it appear as a payment to me?

Those two were question 2, lol. I may be cheating with the number of questions I promised, but...

Thanks for your time, fellow Sellers.

Calculating Fees and profits

Hi

3 images are attached. The Revenue Calculator image shows, I suppose it's a best guestimate, which just about matches the final statements of the Transaction Details page.

But I have two questions:

1: In the Revenue Calculator I input zero for VAT. As the amounts seem to be correct, does that mean that the customer has paid the VAT? And where can I find invoices for each sale detailing this?

Those two were question 1, lol.

2: In the fourth image attached, Customer Shipping Sales, I have noted that some customers are paying for shipping, whilst the majority are not. Why is this, and why does it appear as a payment to me?

Those two were question 2, lol. I may be cheating with the number of questions I promised, but...

Thanks for your time, fellow Sellers.

9 replies

Seller_ZJhFeE3tNKzfh

You would I imagine have to put 20% into the VAT column given you are VAT registered. This then calculates the VAT due to the UK government.

The customer will have paid a VAT inclusive price - but I assume its up to you to pay your VAT bill.

I'd imagine that some custoemrs are buying but aren't Prime customers - so have chosen a delivery service. Not sure as we don't do FBA as to why this would appear as a payment to you - sorry.

Seller_QuM1AZgzfU9x4

You should also note that the revenue calculator doesn't show the VAT on Amazon's fees.