Do I have to pay this? MarketplaceFacilitatorVAT-Principal

Hi,

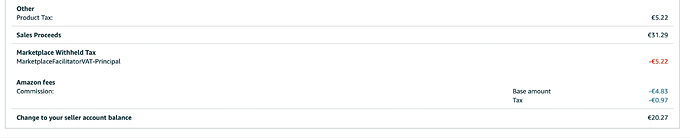

Do I have to pay this “MarketplaceFacilitatorVAT-Principal” ? I am a limited company in the UK and selling in France and Germany. The transaction attached was in France. This just brings down my profit a lot. Would I still I have to pay this if I am registered in that country for VAT specifically. Or any legal ways around this that I might not be aware of?

Thank you

Do I have to pay this? MarketplaceFacilitatorVAT-Principal

Hi,

Do I have to pay this “MarketplaceFacilitatorVAT-Principal” ? I am a limited company in the UK and selling in France and Germany. The transaction attached was in France. This just brings down my profit a lot. Would I still I have to pay this if I am registered in that country for VAT specifically. Or any legal ways around this that I might not be aware of?

Thank you

20 replies

Seller_Vb7VBx6mzvdLs

Yes, even if you were registered for VAT in those countries, VAT would be automatically withheld. But at least you don’t have to pay it in the UK

If you buy and sell goods, especially internationally, you should really live and breathe VAT. It is an integral part of commerce.

Seller_ae51e0CJoHqCX

Yes, IOSS stands for International One Stop Shop.

It basically means that Amazon take out the VAT instead of you doing it, hence you don’t pay the VAT twice. There will be 3 instances whereby it doesn’t get through without issues

- It doesn’t qualify as IOSS

- It qualifies but you have filled the paperwork out wrong or sent on a wrong service HS code etc

- You have done everything right but customs have got it wrong.

Amazon will inform you whether the VAT has been taken care of. When you go into the order, you will see a yellow box saying IOSS. In this instance you send the order under IOSS. If it is missing then you have to deal with the VAT by sending it DDP (Delivered Duty Paid).

The longer I have been doing it, the less issues I seem to get with it. This is because I now know what I am doing and double check things, I know when and where customs have got it wrong and quick to act on it. To be fair I get the odd customs issue here and there but it is definitely under 1 percent. If you are getting more back than are getting through I am going to stick my neck out and say it is likely something you are not getting quite right.