Your disbursements have been deactivated in all stores you operate worldwide (excluding Amazon.in) from 14 12 2023 as we have indicators that you might not be EU established for VAT purposes.

Hello, today I received this message from Amazon. They ask to send a huge list of documents but I dont have the part of it because there is no office or employees. Just me being a non -EU resident but the company and director are in Ireland. What should we do??

Your disbursements have been deactivated in all stores you operate worldwide (excluding Amazon.in) from 14 12 2023 as we have indicators that you might not be EU established for VAT purposes. As a result, we need you to provide additional documentary evidence proving that your company is established in the EU in accordance with this legislation, within 60 days of this notification.

Why did this happen?

From 1 July 2021, Amazon is liable to collect and remit VAT on B2C sales from non-EU established Selling Partners to B2C customers in EU under the EU VAT on e-Commerce legislation. We have taken this measure because as per investigation taken on your account, we found indicators that that your business is established outside the EU for VAT purposes. Hence, we need to get the documentary evidence to ensure we apply the correct treatment to your B2C sales.

I am established in the EU. How do I get my disbursements released?

If you believe you meet EU business establishment requirements, submit the required documents to the mail-id corresponding to your country of establishment provided on the ‘Determination of Establishment for EU VAT’ page: https://sellercentral.amazon.co.uk/gc/vat-education/voec-uk-establishment.

Note that you have to send the documents required using your Amazon Seller Central registered email id. It will take us up to 3 days to review the documents provided by you. At any point, if we conclude based on the provided documentary evidence that your company is established in the EU, we will release your disbursements within 24 hours of completing the verification. This will become available to you as per your normal payment cycle.

I do not meet EU establishment requirements. How can I get my disbursements released?

Send an email to drtax-nonestablished@amazon.co.uk from your seller central registered mail id and inform us (i) that you are not established and (ii) the country from which you operate. There is no requirement to provide any documentation where this is confirmed as being non-EU.

In such a case, additionally, you will be required to pay the VAT amount to Amazon to account for the historical un-paid VAT on all B2C sales that fall under EU VAT on eCommerce legislation since 1 July 2021. We will inform you the next steps within one week after receiving your email.

Note: Do not send any documents to this id drtax-nonestablished@amazon.co.uk if you are established in the EU. Documentary evidence to prove that you are established in the EU should only be sent as per the instructions in the section above.

What happens if I don’t take the required actions?

If you fail to provide the documentary evidence within 60 days of this notification, we will conclude that you are not established in EU and will start collecting and remitting VAT on your B2C sales. In such a case, additionally, you will be required to pay the VAT amount to Amazon to account for the historical un-paid VAT on all B2C sales that fall under EU VAT on eCommerce legislation since 1 July 2021. You may continue selling on Amazon, but you will not be able to disburse any funds from your accounts, until any EU VAT owed is paid t

30 replies

Seller_ZJhFeE3tNKzfh

Your issue is likely to relate to this paragraph below. You've already stated that there is no office or employees - so amazon are looking for proof you are physically operated from within the EU.

Amazon is required to make a determination of whether Selling Partners are “established” in the EU for VAT purposes which requires that the business is physically operated from within the EU with sufficient resources. The sole use of an EU-incorporated legal entity without any physical operations within the EU does not meet this definition

Seller_BmvWY2s9RUQe0

Hi @Seller_wc3hEgm0kJ23u did you manage to solve this? The same is happening to me, my business is incorporated in the UK but I live in Spain and have no offices or employees. How did you prove establishment?

Seller_171whtfaYxvhd

Amazon simply wants to know that all our businesses are placed where we are, and we need to prove this by sending them, the relevant documents (identiy card, electricity/water bills, certifaces of share allotments, registry extracts, supplier invoices, etc)

Seller_171whtfaYxvhd

Hello @Abella_Amazon

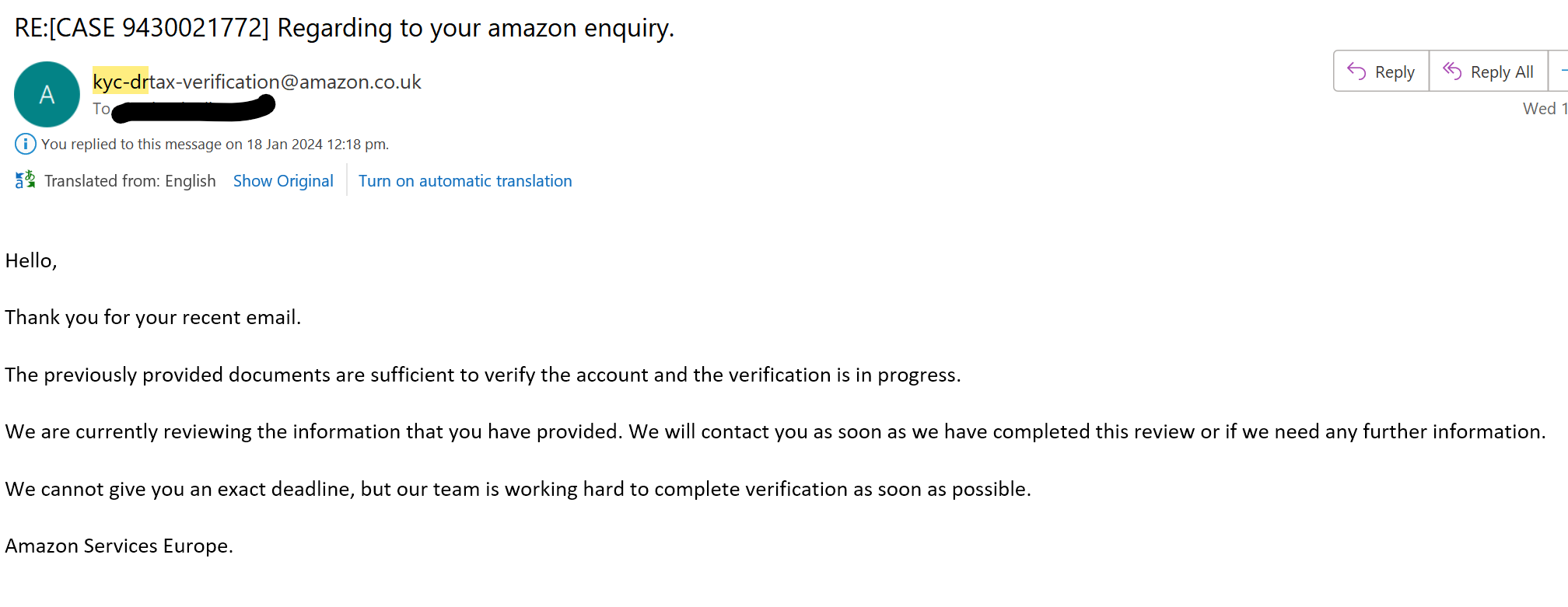

My disbursements went on hold on January 16, 2024 stating by KyC-drtax amazon uk that they have indicators that i might not based within EU and the wanted documentation to prove this so immediatelly i provided the requested documents. Then i was getting repeated emails asking me the same thing to provide again and again the same documentation.

Here is the last notification i got on my email received by kyc-drtax amazon.co.uk on January 17, 2024. The case id is 9430021772 but is not shown on my case log, i don't know why. (Please see screenshot below)

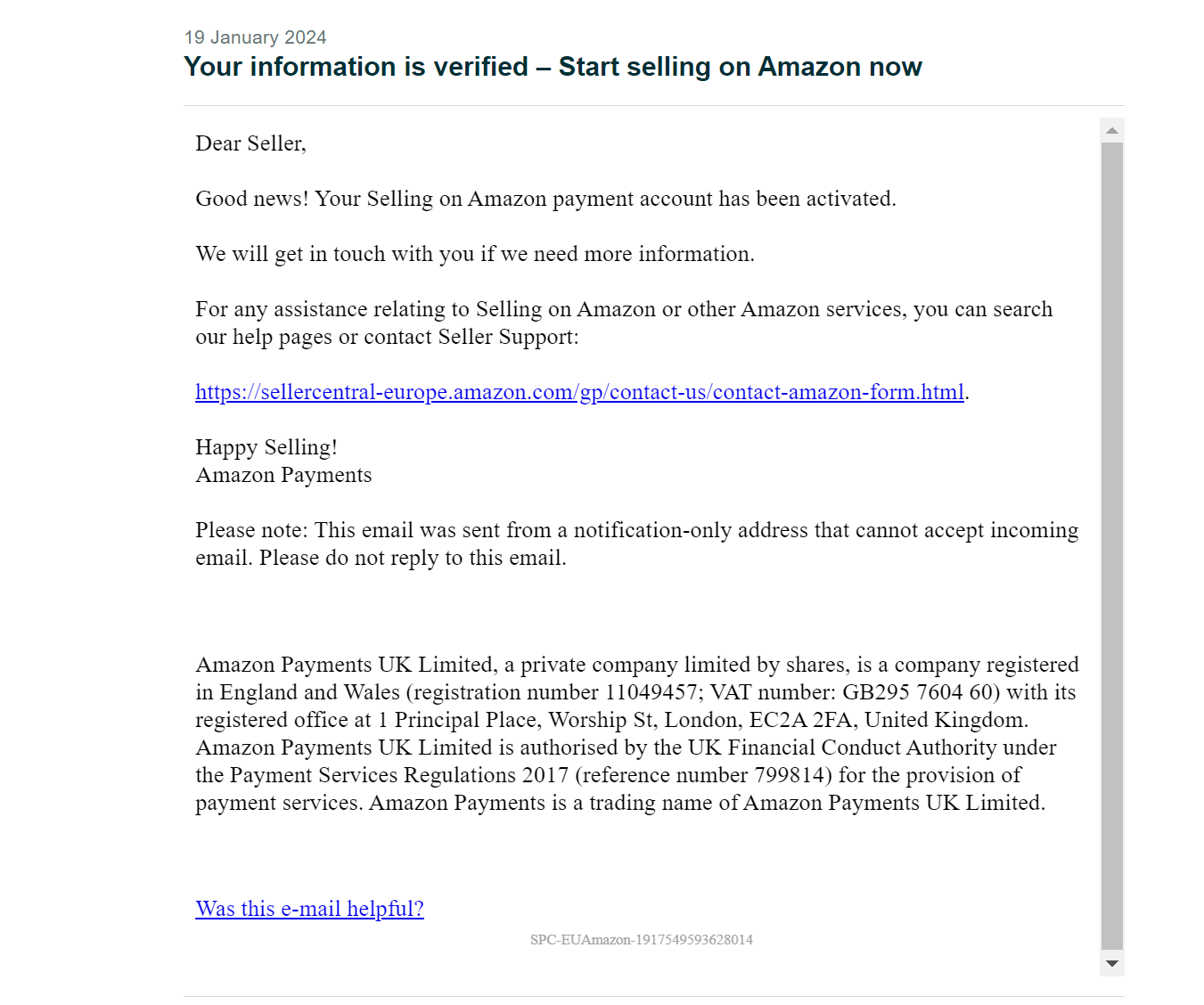

1. The first verification on my account verification came from the seller-verification@amazon.co.uk and it took 13 days (January 6, 2024 until January 19, 2024) [Please see screenshot below]

2, The kyc-drtax@amazon.co.uk which withholds my disbursements since January 16, 2024 has not yet been resolved unfortunatelly and my earnings are still on hold. (January 16, 2024 - still on unknown)

I cannot run my business without any penny, and who knows when my money will be restored