Advice Needed: VAT Number

Hi, some advice needed on this. In October 2023, I agreed, with the advice of my accountants due to low sales, to de-register for VAT with HMRC. This is because my sales were below £85,000 (A combination of supplier issues and some other stuff).

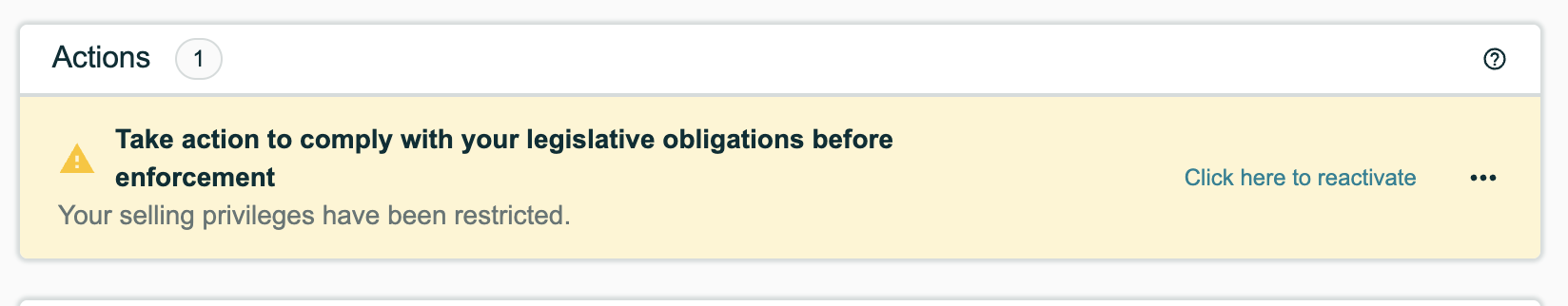

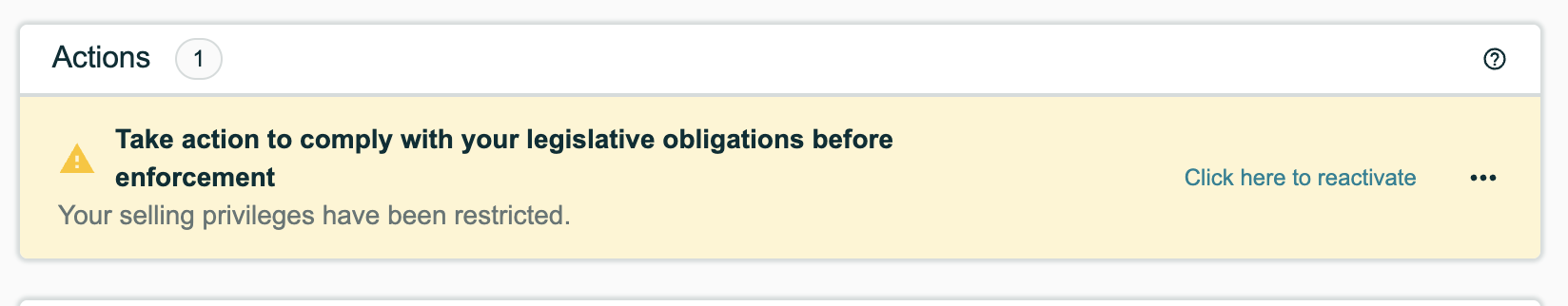

Amazon picked up on this fact around February and while I was waiting to get stock re-made & shipped (i currently have 1000 units on their way to UK), i keep seeing this message. When i click "click here to reactivate" it basically takes me to a page where i need to prove my business exists in the UK, and to provide Utility bills for warehouses that i use (even though my product is FBA), i think they are complicating a simple issue.

My question: Even though i am not earning any money, do i still need a VAT Number for Amazon? Because then I will need to re-register a VAT number with HMRC again, and basically just declare £0 every 3 months, which i feel is a bit stupid.

I'm worried that i'll get stock into amazon again, and then they will hold my disbursements.

I think after these units sell, i'll be long gone from Amazon as every situation is an absolute nightmare.

Advice Needed: VAT Number

Hi, some advice needed on this. In October 2023, I agreed, with the advice of my accountants due to low sales, to de-register for VAT with HMRC. This is because my sales were below £85,000 (A combination of supplier issues and some other stuff).

Amazon picked up on this fact around February and while I was waiting to get stock re-made & shipped (i currently have 1000 units on their way to UK), i keep seeing this message. When i click "click here to reactivate" it basically takes me to a page where i need to prove my business exists in the UK, and to provide Utility bills for warehouses that i use (even though my product is FBA), i think they are complicating a simple issue.

My question: Even though i am not earning any money, do i still need a VAT Number for Amazon? Because then I will need to re-register a VAT number with HMRC again, and basically just declare £0 every 3 months, which i feel is a bit stupid.

I'm worried that i'll get stock into amazon again, and then they will hold my disbursements.

I think after these units sell, i'll be long gone from Amazon as every situation is an absolute nightmare.

10 replies

Seller_RlZVPg3d6ZUGP

Have you proved you are UK established as they've asked? do you have non UK addresses on your account somewhere?

You wouldnt be declaring £0 you'd be declaring your actual income and still paying VAT on it if you reregistered

Sarah_Amzn

Hello @Seller_w17Me6UR8qFuf,

I'm Sarah with Amazon.

An evidence of physical operation can also include:

- A recent UK council tax bill or business rates of the current year, addressed to the company or a director of the company.

- A recent utility bill dated within 180 days addressed to the company or the director of the company.

Once your review is complete and your UK establishment is verified, the VAT team will provide you with details regarding your VAT status.

Kind regards,

Sarah