Please help to clarify the calculation date range and total amount of UK historical VAT

Dear Amazon,

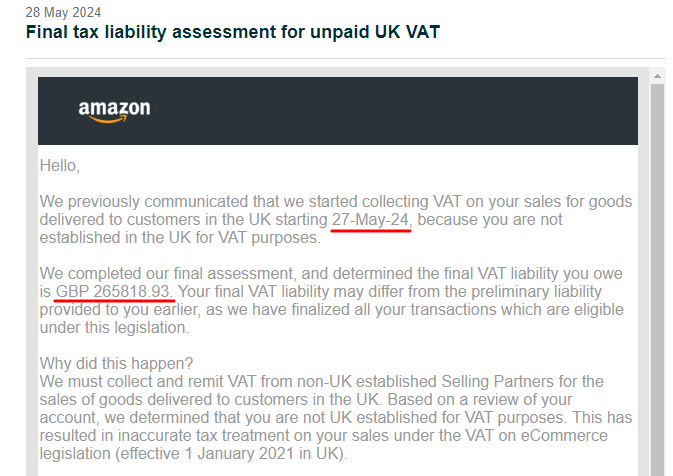

We received the【Final Tax Liability Assessment for Unpaid UK VAT】from Amazon on 28th May this year (as you can see in the attachment), informing us that we need to pay the VAT amount to Amazon for the historical unpaid VAT: £265,818.93.

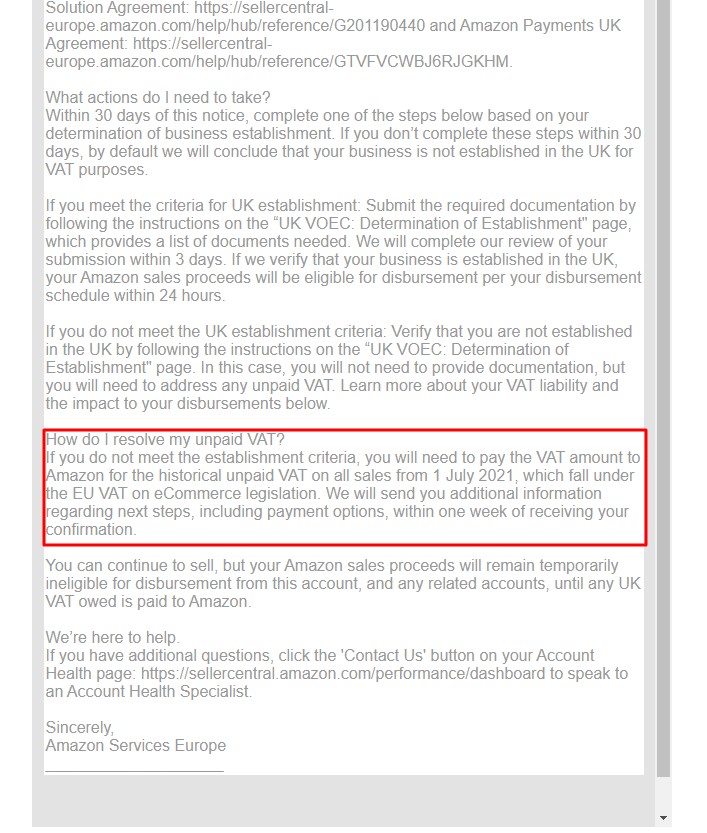

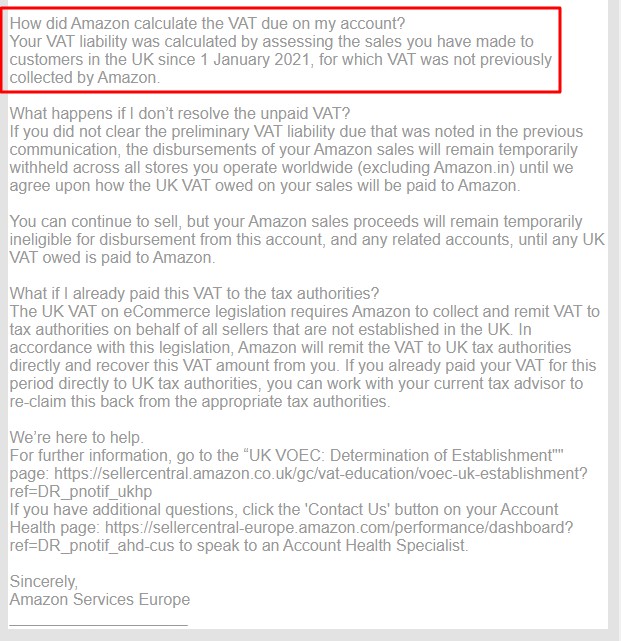

And also received the first notification from Amazon on 10th April this year: 【Action Required - Your disbursements are at risk of being temporarily held】, which mentions: "If you do not meet the establishment criteria, you will need to pay the VAT amount to Amazon for the historical unpaid VAT on all sales from 1st July 2021, which fall under the EU VAT on eCommerce legislation."

So, we would like to confirm the following questions with you:

1. Does the calculation period of this historical VAT start from 1st January, 2021? Or from 1st July, 2021?

2. Is this correct amount of VAT owed calculated until 27th May of this year?

Here to share the case ID: 9955644112

Hope to hear from you soon.

Thanks and best regards,

Ellie

Addlink Technology Team

6 replies

Seller_ZOX9XGpVRPRwb

Dear @Abella_Amazon,

Could you please help us to solve this problem?

Hope to hear from you soon.

Thanks and best regards,

Ellie

Addlink Technology Team

Seller_ZOX9XGpVRPRwb

Dear Amazon,

Can anyone give us a response? We are still waiting for your information.

Hope to hear from you soon.

Thanks and best regards,

Ellie

Addlink Technology Team

Sakura_Amazon_

Hello @Seller_ZOX9XGpVRPRwb,

I checked the case ID that you shared here, and I see that it is being transferred to the different Teams. I have contacted the Partner Team to review it, and I will keep you updated. Please share here if you get a response.

The Help Page that @Seller_ZVAz3d5lZuGid wanted to share is this one:UK VAT on e-Commerce (UK VOEC) Legislation – 2021 Determination of "Establishment" for UK VAT

I advise you to review it, as it contains information about this topic.

Regards,

Sakura

Seller_4yDEUzjvQhoZX

hiya. We're in the same situation. Amazon will send you a final calculation and that is going to be the definitive amount that you need to pay back. In the meantime, you need to request for a refund by HMRC submitting the errors in VAT calculations form (or something similar). The refund takes more than a month so brace yourself. Once you receive the refund, you will need to pay Amazon back but even at that time, you will wait for some time until settlement funds are released because it takes weeks until Amazon processes the VAT payment. Good luck