Fee help

Hi,

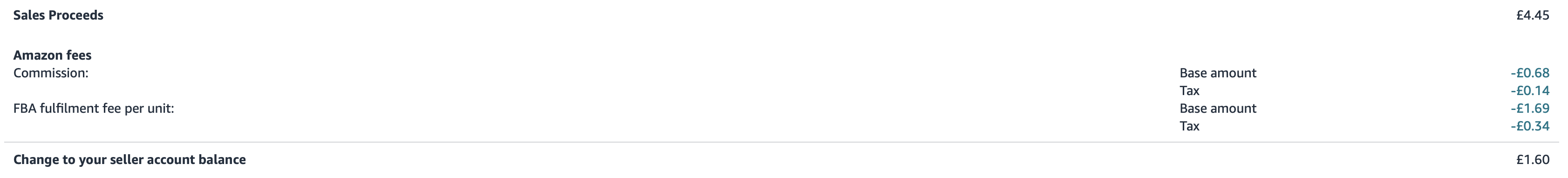

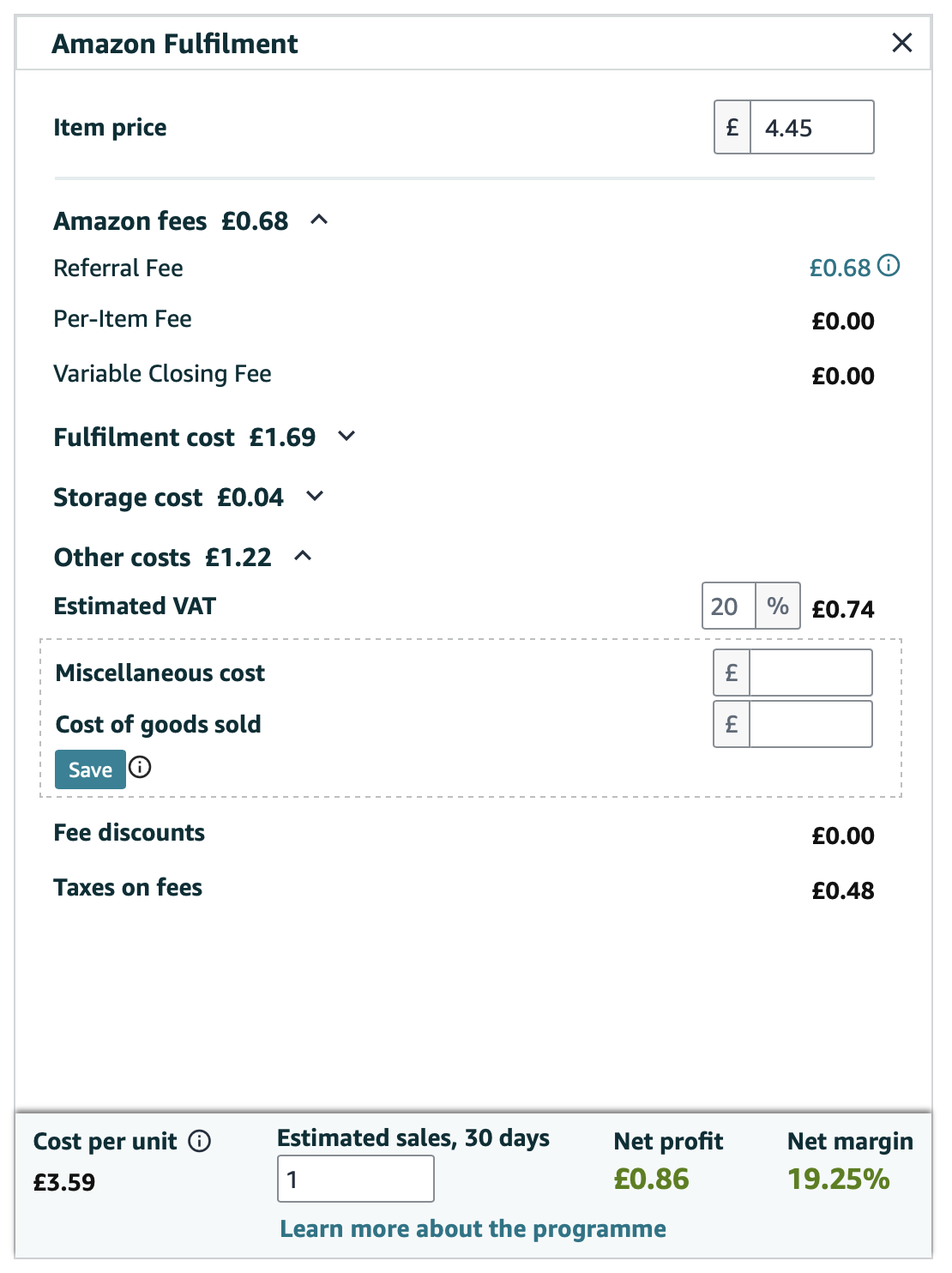

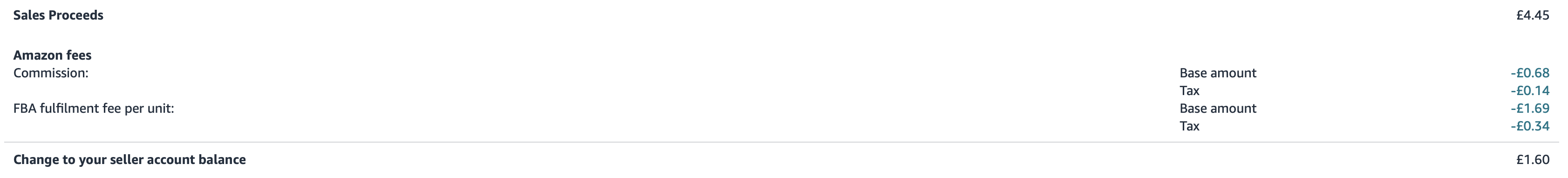

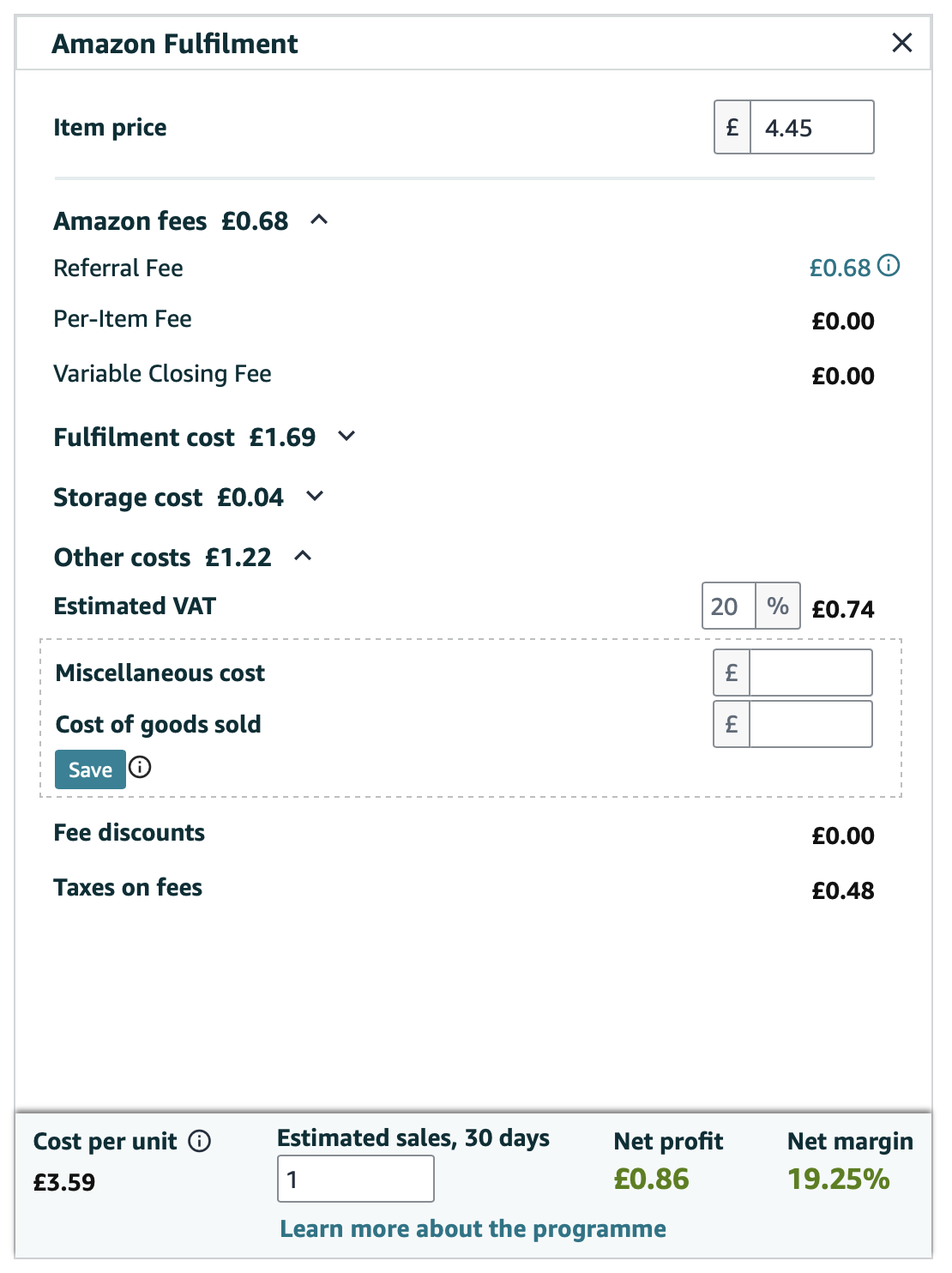

I’m noticing a discrepancy between the fee breakdown on my transaction page and the Amazon Revenue Calculator. Specifically, the calculator shows an estimated VAT of 20% (£0.74) that isn’t reflected in my actual transaction fees. I thought Amazon would only charge VAT on its fees, not on the sale price of my products.

Could you help clarify where this VAT charge is coming from and why it isn’t showing up in my transaction fees? Additionally, could you confirm if the VAT rate applied matches what is used in the calculator?

Thank you!

Fee help

Hi,

I’m noticing a discrepancy between the fee breakdown on my transaction page and the Amazon Revenue Calculator. Specifically, the calculator shows an estimated VAT of 20% (£0.74) that isn’t reflected in my actual transaction fees. I thought Amazon would only charge VAT on its fees, not on the sale price of my products.

Could you help clarify where this VAT charge is coming from and why it isn’t showing up in my transaction fees? Additionally, could you confirm if the VAT rate applied matches what is used in the calculator?

Thank you!

6 replies

Seller_76AUwmqvSyRIM

74p is the vat portion of the selling price so the calculator is including this as part of the calculation.

My guess is that you are not registered so you need to change the 20% figure to 0% for the calculator to work properly. I'm not sure whether you can change it on that screen or somewhere else as I don't use the calculator.

Seller_76AUwmqvSyRIM

No. you will receive that amount.

Just delete the 20 and enter 0. It works on my screen.

Seller_zr1oNvrWt7RHA

tax on fees is taking our profit which is .48p on your item showing you can claim that back if you r registered for VAT