Tax liability assessment for unpaid UK VAT - for that period the company did not exist

Hello!

I need an advisor or anything related to Amazon UK VAT assessment a consultant maybe someone with the same issue how can help me or ...anything that can guide me ... or dear :

@Spencer_Amazon @Ezra_Amazon @Winston_Amazon @Julia_Amazon @Sakura_Amazon_ @Sarah_Amzn @Simon_Amazon

The story is this:

The Amazon account was held by 3 UK registered companies as follows:

1. From the beginning till 2022-03-08 - Comany1 LTD (directors - owner-presidents was a UK resident )

2. From 2022-03-08 to 2023-09-10 - Company2 LTD (directors - owner-presidents was a UK resident )

3. From 2023-09-10 till the present - Company 3 LTD has a UK NON-RESIDENT director in my name.

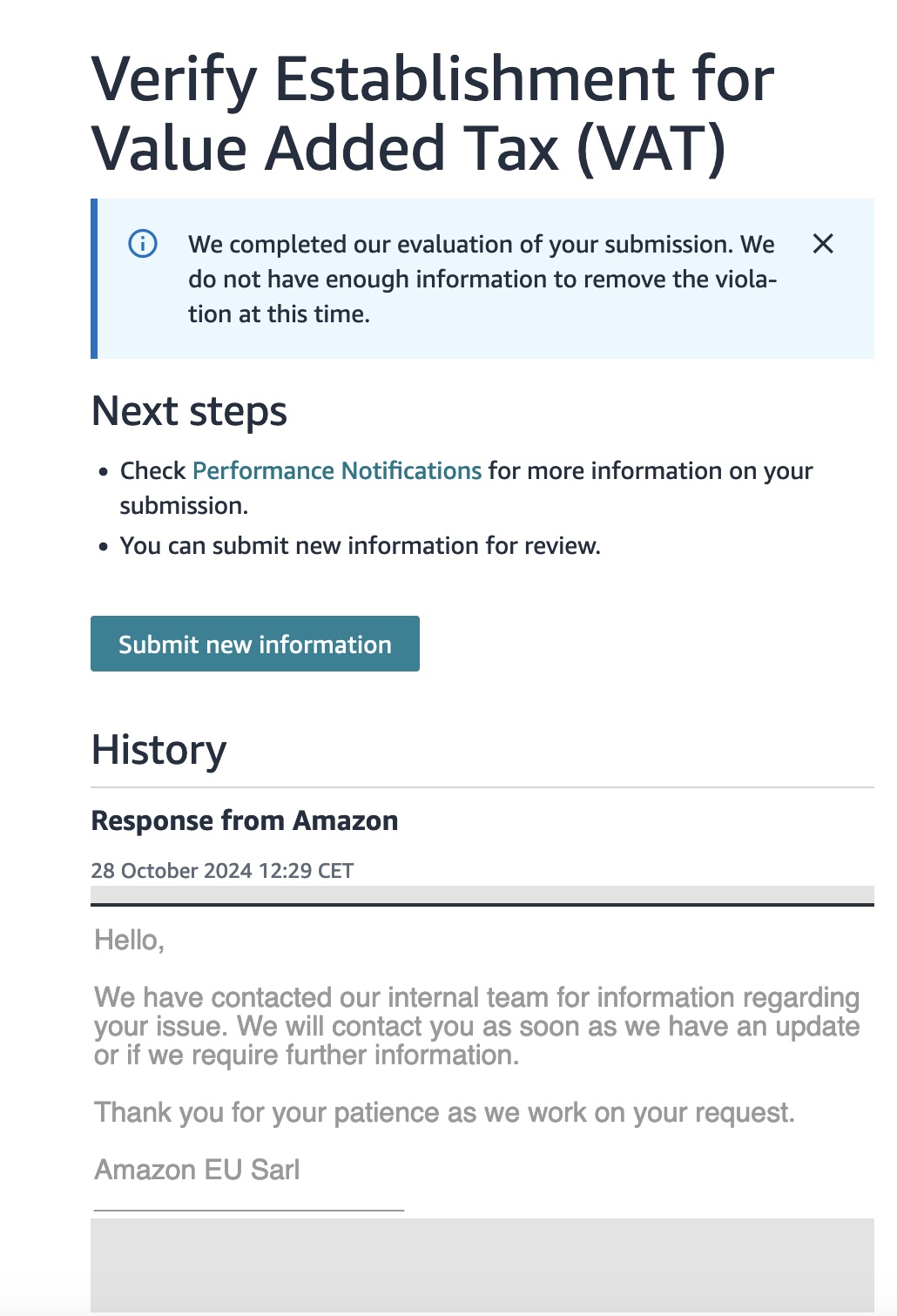

In April 2024 I sent a lot of documents and finally, they said OK, you need to wait for an answer ... and

In August 2024 On August 19, 2024, I received a notification (No action Required - Final tax liability assessment for unpaid UK VAT) in which you said that you completed the assessment and did NOT OWE any amount of VAT for the current company from 10-Sep-23.

On August 24, 2024, we received a new notification (Determination of non-UK establishment) in which you said that an expert human review to identify this issue and told me that I have to pay VAT for the sales of goods delivered to customers in the UK starting from 1 January 2021.

The current Company 3 LTD was founded in 2023 August how can we pay for something sold in 2021 when the company does not even exist?

We always receive this answer:

“Hello, We have contacted our internal team for information regarding your issue. We will contact you as soon as we have an update or if we require further information.

Thank you for your patience as we work on your request. Amazon EU Sarl“

or

"Hello,

Thank you for writing to us regarding your seller account. Your case has been transferred to the specialized team, you will receive a response in the next 72 hours. "

NO REAL ANSWER I receive ... I open many cases I Speak on the phone with them (support seller and Account Health Specialist.) many many times... always the same answer.

I have opened many many cases from April till now and the same answer:

“we will contact you”

Cases: 10422616842, 10391390362, 10372502082, 10093548122, 9988902422, 10031451322, 10031528882, 9995653932, 9978203702, 9978426072, 9968341392, 9978203702, 9931260842, 9817753382 ….

I need HELP to solve this issue.

Is there someone here who can help me with any guidance?

I really don't know what to write to them anymore and what to do. the same stupid-nonsense answer every time.

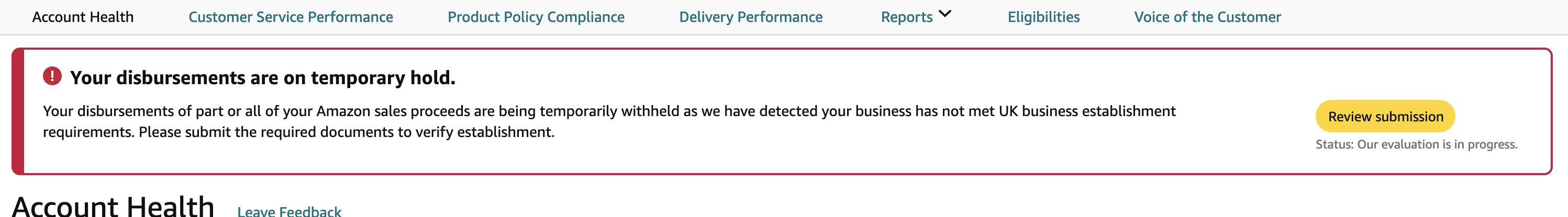

Please ... any advice will be welcome. I have the account blocked since April which means near to 8 months.

Thank you

Tax liability assessment for unpaid UK VAT - for that period the company did not exist

Hello!

I need an advisor or anything related to Amazon UK VAT assessment a consultant maybe someone with the same issue how can help me or ...anything that can guide me ... or dear :

@Spencer_Amazon @Ezra_Amazon @Winston_Amazon @Julia_Amazon @Sakura_Amazon_ @Sarah_Amzn @Simon_Amazon

The story is this:

The Amazon account was held by 3 UK registered companies as follows:

1. From the beginning till 2022-03-08 - Comany1 LTD (directors - owner-presidents was a UK resident )

2. From 2022-03-08 to 2023-09-10 - Company2 LTD (directors - owner-presidents was a UK resident )

3. From 2023-09-10 till the present - Company 3 LTD has a UK NON-RESIDENT director in my name.

In April 2024 I sent a lot of documents and finally, they said OK, you need to wait for an answer ... and

In August 2024 On August 19, 2024, I received a notification (No action Required - Final tax liability assessment for unpaid UK VAT) in which you said that you completed the assessment and did NOT OWE any amount of VAT for the current company from 10-Sep-23.

On August 24, 2024, we received a new notification (Determination of non-UK establishment) in which you said that an expert human review to identify this issue and told me that I have to pay VAT for the sales of goods delivered to customers in the UK starting from 1 January 2021.

The current Company 3 LTD was founded in 2023 August how can we pay for something sold in 2021 when the company does not even exist?

We always receive this answer:

“Hello, We have contacted our internal team for information regarding your issue. We will contact you as soon as we have an update or if we require further information.

Thank you for your patience as we work on your request. Amazon EU Sarl“

or

"Hello,

Thank you for writing to us regarding your seller account. Your case has been transferred to the specialized team, you will receive a response in the next 72 hours. "

NO REAL ANSWER I receive ... I open many cases I Speak on the phone with them (support seller and Account Health Specialist.) many many times... always the same answer.

I have opened many many cases from April till now and the same answer:

“we will contact you”

Cases: 10422616842, 10391390362, 10372502082, 10093548122, 9988902422, 10031451322, 10031528882, 9995653932, 9978203702, 9978426072, 9968341392, 9978203702, 9931260842, 9817753382 ….

I need HELP to solve this issue.

Is there someone here who can help me with any guidance?

I really don't know what to write to them anymore and what to do. the same stupid-nonsense answer every time.

Please ... any advice will be welcome. I have the account blocked since April which means near to 8 months.

Thank you

2 replies

Seller_4iW8YaYqSMbSC

Hello! @Julia_Amazon

I saw that you somehow helped some users. Do you think you can help me with this issue as well? I recently uploaded the same documents again; maybe something could move or change, but nothing...the same automatic response for nine months.

Thank you very much;

it would be of great help to me.

Abella_AMZ

Hello @Seller_4iW8YaYqSMbSC,

This is Abella from Amazon to assist you.

We greatly appreciate you reaching out with your inquiry. Rest assured, we are committed to putting forth our utmost efforts to assist you with your query.

It appears that your funds are being held for the VAT process.

From January 1, 2021, Amazon will be responsible for collecting UK VAT on the following sales of goods delivered to customers in the UK where ordered through any Amazon storefront

Where either of these supplies take place, Amazon will calculate and collect UK VAT from the customer at checkout and remit this directly to the UK Tax Authorities. You will not receive the UK VAT amount in your disbursements and will not be required to remit these amounts to the UK Tax Authorities.

If you qualify for UK establishment: Please submit the necessary documentation. Our review process will be completed within 3 days. Upon verification of your UK establishment, your Amazon sales proceeds will become eligible for disbursement according to your disbursement schedule, typically within 24 hours. Furthermore, if your Fulfilment by Amazon (FBA) inventory was held, it will be ready for removal within 48 hours.

If you do not meet the UK establishment criteria: Confirm that you are not established in the UK. In this scenario, documentation submission is not required, but you will need to resolve any outstanding VAT payments.

However, for better understanding of the issue, I would request you to share the last performance notification that you received from the team so that we can go through it and provide more insights on the same.

If you need any further assistance, you can post here so that we or any of the sellers on forum can help you.

Regards,

Abella.