Tax isn't showing on some products

For some reason on the sandals I am selling there is no tax being charged to the customer. Which means I have to end up paying it in the end. All other products I have listed are charging the customer the tax. The first time it happened I thought okay maybe they are tax exempt but it is literally every pair of sandals sold. Anyone know how to fix this problem?

Tax isn't showing on some products

For some reason on the sandals I am selling there is no tax being charged to the customer. Which means I have to end up paying it in the end. All other products I have listed are charging the customer the tax. The first time it happened I thought okay maybe they are tax exempt but it is literally every pair of sandals sold. Anyone know how to fix this problem?

6 replies

Seller_LImVvUWeyiCfQ

Seller_Hi7wbO2Kbo6bl

Assuming you are talking about sales on the dot com site, and the tax you reference is sales tax -- you have no control.

This is now controlled by Amazon. Other than keeping track of total sales to buyers in your state, it concerns you not in the least.

If Amazon does it wrong or right, it does not concern you, nor can you influence this in any way.

You may (probably will) have to report those sales when you file your sales tax -- but they are then backed out as having tax already collected.

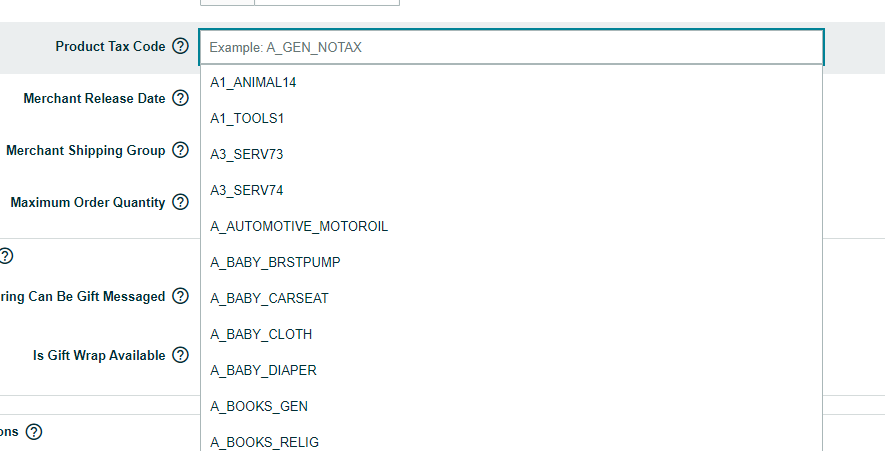

It does not matter at all what (if anything) you filled into that tax code field, and there is no point in ever using it again.

Seller_nRFmxiQg4EGrw

There are some states, including NJ (not sure about others) where sandals would not be subject to sales tax; therefore, for sales to those states, Amazon does not collect any, nor is there any sales tax due.

For the other states, Amazon is the party responsible for collecting the tax. If they fail, that is THEIR liability.

As pointed out by April, there is nothing that you have to "end up paying in the end".

Seller_2srXkS44rN39i

Another thing not pointed out is that some buyers are tax exempt. They might be a charity, another form of tax exempt organization, or might be a business for resale. They might be buying a few items for a retail store, or some items to resell elsewhere online or a freebie pack in with a shipment (get a free pair of sunglasses on orders over $25)