Foreign(UK) seller selling on Amazon FBA US getting charged tax?

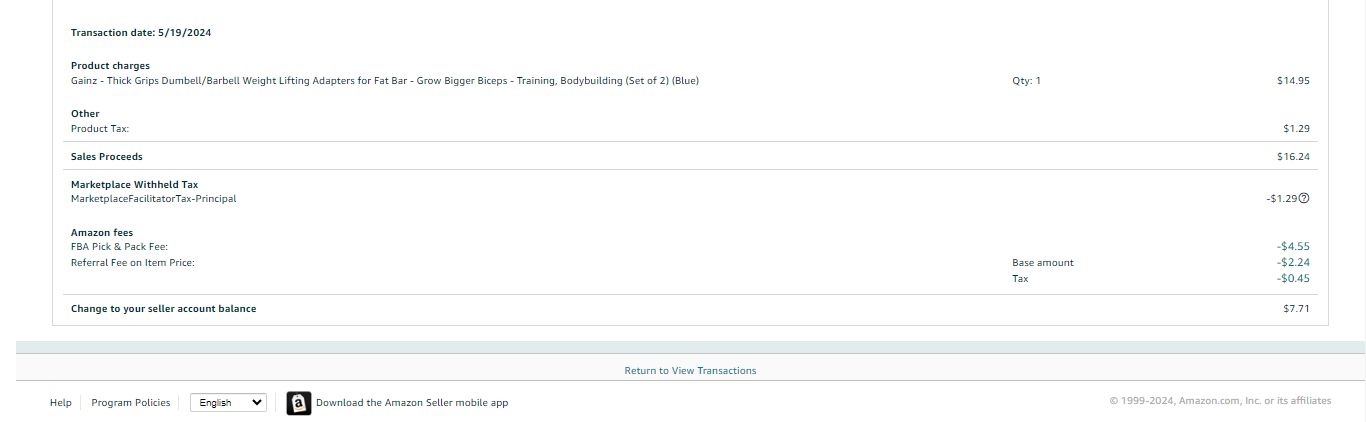

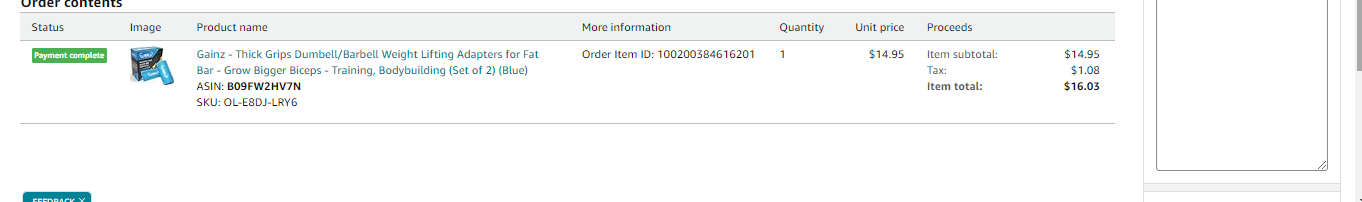

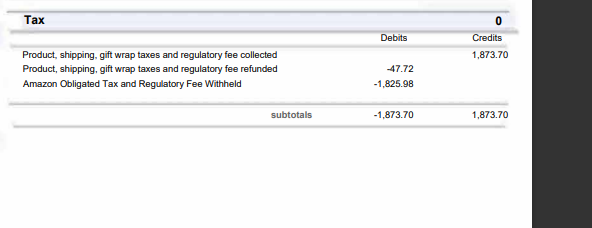

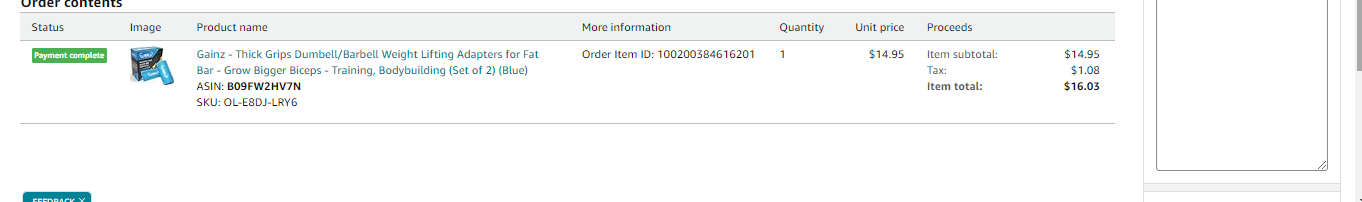

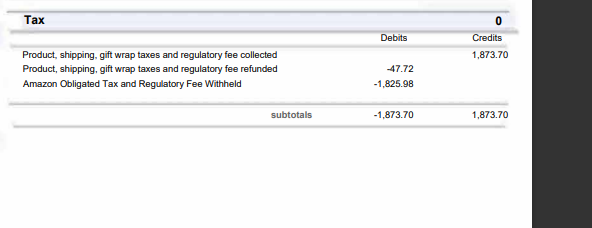

Hello as far as I'm aware UK sellers selling in US are not meant to be getting charged any tax. It does prove that on my Seller Report as it takes away 1873.70 and then adds that amount back on to charge 0 tax in the end. However if I go into the order page it says that I get charged $1.08 per product, but on the payments page it shows $0.45 on the same transaction.

Do I actually get charged tax on the product the moment they are sold? And if so can I claim it back on my foreign tax relief?

Foreign(UK) seller selling on Amazon FBA US getting charged tax?

Hello as far as I'm aware UK sellers selling in US are not meant to be getting charged any tax. It does prove that on my Seller Report as it takes away 1873.70 and then adds that amount back on to charge 0 tax in the end. However if I go into the order page it says that I get charged $1.08 per product, but on the payments page it shows $0.45 on the same transaction.

Do I actually get charged tax on the product the moment they are sold? And if so can I claim it back on my foreign tax relief?

4 replies

Seller_4zBzdtgCyS9EI

Seller_nRFmxiQg4EGrw

I'm not 100% sure, but I think that the $1.08 tax you are seeing on the order page is not tax to you as the seller, but rather the sales tax that would be paid if you were the customer. On the actual order that you showed, there is $1.29 collected from the customer; then below, there is a line for Marketplace Withheld Tax, where there is an amount of -$1.29 canceling that out (in regards to the money you see). The -$.45 is a separate entry; I assume that is the amount of tax that is cooked into the fee; as a US seller, I've never seen this entry, so I suspect that I'm paying the tax without it being broken out as a separate item.

Note that in the US, sales tax varies by state, and sometimes by city or county within states, so you will see different tax charged on orders for the same item, so that could explain why you see $1.08 in one place, and $1.29 in another.

But I'll admit as someone not familiar with the details of a non-US seller selling here, I might be mistaken or missing something important.

Micah_Amazon

Hello @Seller_Bj41f4LUl3LyU,

Thank you for reaching out. We are not able to provide tax solutions or suggestions, however, I can point you to the help pages we have which may help you get a better understanding. However, this is a great opportunity for experienced sellers in this area to chime in.

Please see the following:

- UK and EU VAT on E-commerce legislation

- VAT information in your Amazon Seller Central account

- Tax registration and agreements (VAT or GST)

Those should help for now. Please let me know if you have any additional questions.

Cheers,

Micah