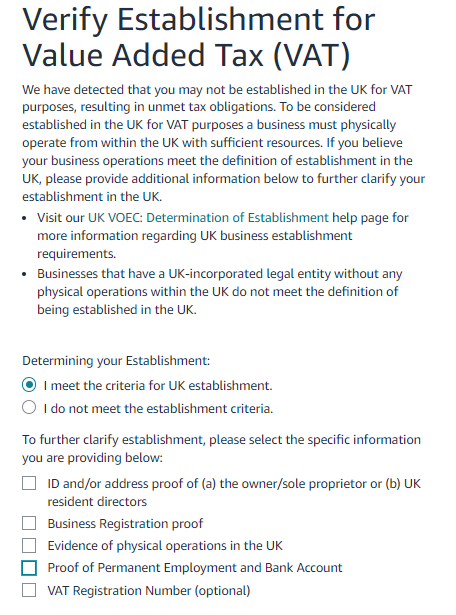

Verify Establoshment for VAT

A little context, i am a non UK resident with an established ltd company here in the UK.

From the above i can provide all except the first one, is that an issue.

Secondly for proof of permanent employment I have to provide PAYE as per amazon. Amazon says "HMRC correspondence demonstrating the Selling Partner has registered with HMRC for PAYE, less than 180 days old; or......."

My question is can a company belonging to a non UK resident register for PAYE ?

Thank You

Verify Establoshment for VAT

A little context, i am a non UK resident with an established ltd company here in the UK.

From the above i can provide all except the first one, is that an issue.

Secondly for proof of permanent employment I have to provide PAYE as per amazon. Amazon says "HMRC correspondence demonstrating the Selling Partner has registered with HMRC for PAYE, less than 180 days old; or......."

My question is can a company belonging to a non UK resident register for PAYE ?

Thank You

3 replies

Seller_76AUwmqvSyRIM

You need to provide all documents. But, may I ask how you plan to provide to prove that your physical operations are carried out in the UK?

Seller_ZVAz3d5lZuGid

If you are a non-UK resident, but have registered you company here (presumably using a virtual address ?) then you are considered as a NETP, and must be VAT registered in UK, especially if you are storing your goods here for FBA.

Sorry cannot answer your question re. PAYE, but would have thought that the HMRC website would have the info., and to be honest, am pretty sure it relates to permanent employment in UK, as that is what PAYE is for.

Seller_MT8rt0A2OpbCx

You have ticked the wrong box. It should be "I do not meet the establishment criteria" as you are not a UK resident. Having a UK office that you cannot actually operate your business from, i.e. a virtual office, does not qualify you to be established in the U.K. for VAT purposes either with HMRC or Amazon.

After ticking the correct box, the rest is irrelevant, including the PAYE part.