VAT registration for EU company

Hi

I sold some itemas via UK FBA.

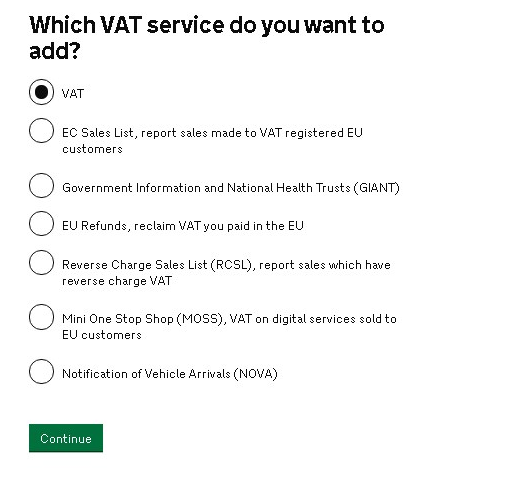

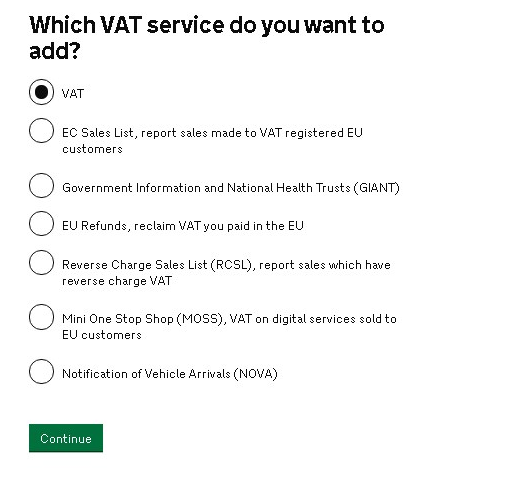

I am registered for vat, but I can not add vat to HMRC online system since my company`s postcode is not from the UK. The support said you can add vat to your HMRC account only with a UK postcode. They wont give me any more info or advise.

Now, am I registering for a wrong thing or does every overseas seller need a local tax agent?

I only sold like 10 items and do not plan to send new ones, so I thought I can manage to pay the vat for these myself.

VAT registration for EU company

Hi

I sold some itemas via UK FBA.

I am registered for vat, but I can not add vat to HMRC online system since my company`s postcode is not from the UK. The support said you can add vat to your HMRC account only with a UK postcode. They wont give me any more info or advise.

Now, am I registering for a wrong thing or does every overseas seller need a local tax agent?

I only sold like 10 items and do not plan to send new ones, so I thought I can manage to pay the vat for these myself.

Seller_w5yfJfSgoSEaJ

Got it, the webchat support gave me an UK postcode.

3 replies

Seller_w5yfJfSgoSEaJ

I will reframe my question.

Is anybody successfully registered for UK VAT through HMRC website with an overseas company?