Profit Calculation Method Question

Hi all

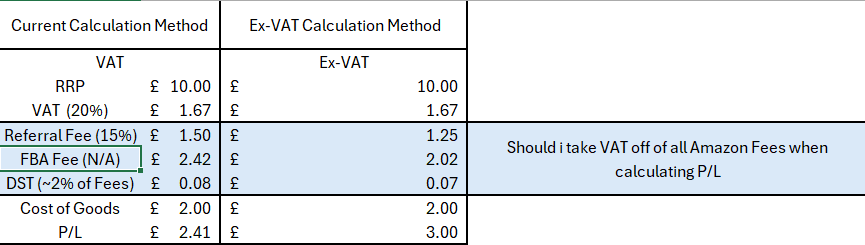

This may seem like a silly question - But when calculating our NET profit, should i take VAT off of Amazon's fees? i.e. Here is my current method of calculation

- We are VAT registered.

- "Ex-VAT" column is based on 20% reduction of fees.

A secondary question, should I take VAT off of Advertising costs?

Profit Calculation Method Question

Hi all

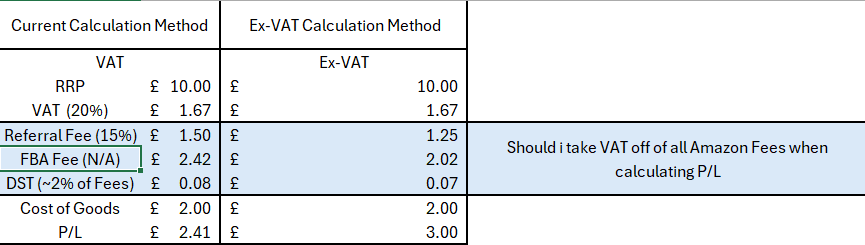

This may seem like a silly question - But when calculating our NET profit, should i take VAT off of Amazon's fees? i.e. Here is my current method of calculation

- We are VAT registered.

- "Ex-VAT" column is based on 20% reduction of fees.

A secondary question, should I take VAT off of Advertising costs?

0 replies

Seller_mS10UjVYuuGor

Your Ex-VAt calculation would be correct (assuming there is no VAT associated with your cost of goods, or the raw materials if you make them). Your advertising cost should also be considered on an ex-VAT basis.

Seller_7pDvjaP1zn6iT

Hi,

Shouldn't the P/L figure be £2.33 for first col and £2.99 for 2nd col?

Don't forget the storage cost either.

Seller_76AUwmqvSyRIM

IMHO, when you are VAT-registered, you should always think ex-VAT for everything.

Seller_QgnlRdJJaJLON

I thought that Amazon charged the Referral Fee at 15% PLUS VAT, so the 15% figure is ex-VAT.

DST does not have VAT applied to it.