Hello,

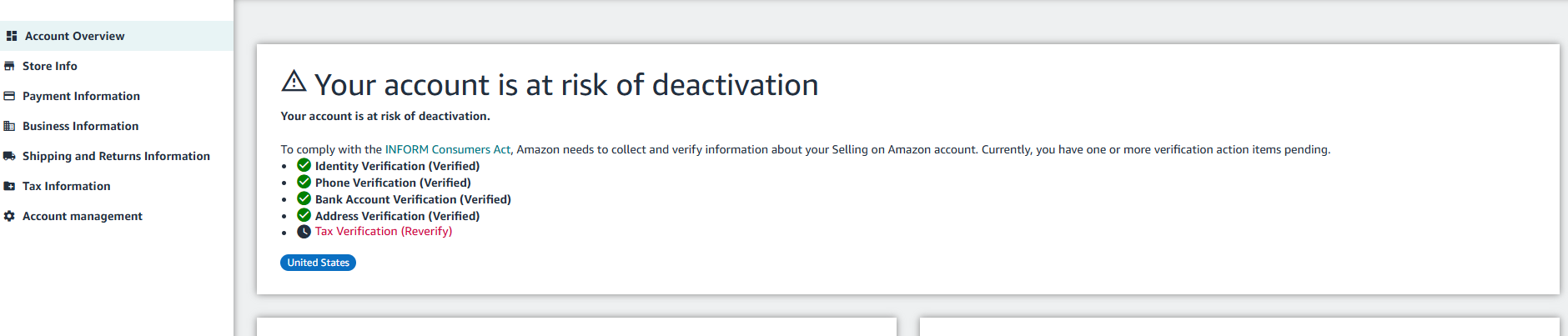

Basically what happened is 3 weeks ago we received an "account risk at deactivation" message on our account stating that our TAX ID is being verified. (We have been successfully selling on Amazon for 3+ years and have never had such an issue.)

We've opened a ticket and have waited more than 3 weeks for an answer from Amazon. We haven't received any still, but yesterday we received the following email from the internal team. (CASE ID: 17203829981 and internal CASE ID received Via Email: [CASE 17326885771] )

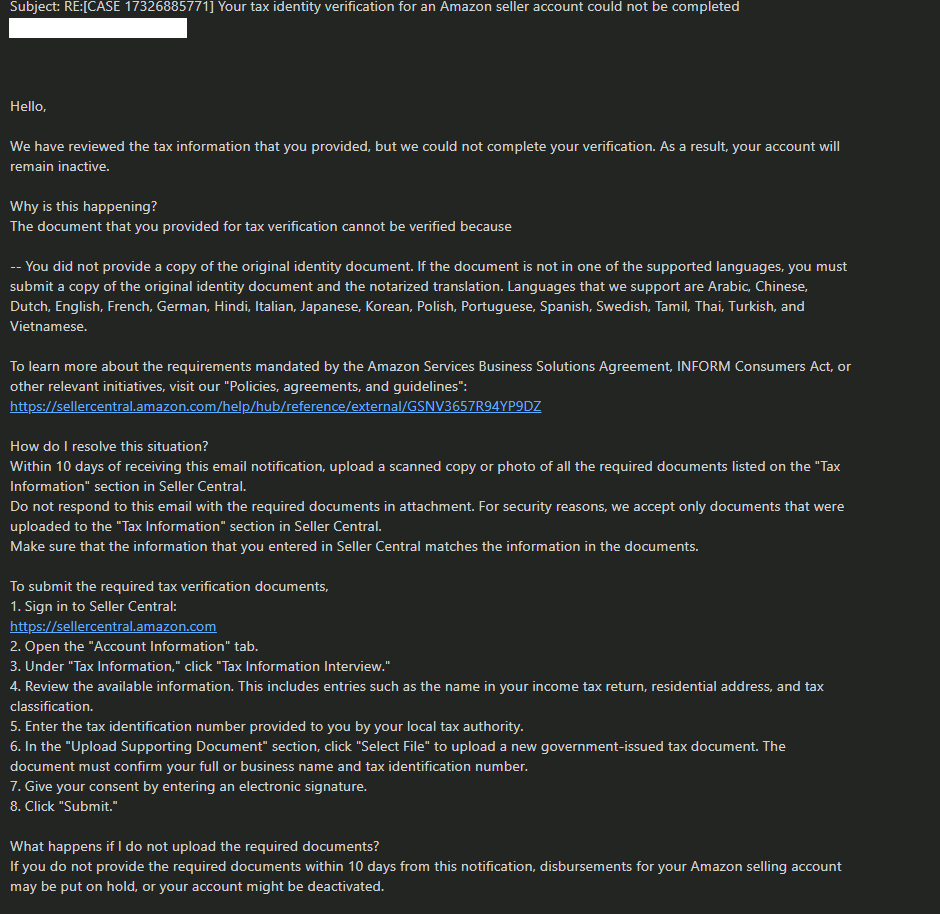

"Hello,

We have reviewed the tax information that you provided, but we could not complete your verification. As a result, your account will remain inactive.

Why is this happening?

The document that you provided for tax verification cannot be verified because

-- You did not provide a copy of the original identity document. If the document is not in one of the supported languages, you must submit a copy of the original identity document and the notarized translation. Languages that we support are Arabic, Chinese, Dutch, English, French, German, Hindi, Italian, Japanese, Korean, Polish, Portuguese, Spanish, Swedish, Tamil, Thai, Turkish, and Vietnamese.

To learn more about the requirements mandated by the Amazon Services Business Solutions Agreement, INFORM Consumers Act, or other relevant initiatives, visit our "Policies, agreements, and guidelines":

https://sellercentral.amazon.com/help/hub/reference/external/GSNV3657R94YP9DZ

How do I resolve this situation?

Within 10 days of receiving this email notification, upload a scanned copy or photo of all the required documents listed on the "Tax Information" section in Seller Central.

Do not respond to this email with the required documents in attachment. For security reasons, we accept only documents that were uploaded to the "Tax Information" section in Seller Central.

Make sure that the information that you entered in Seller Central matches the information in the documents.

To submit the required tax verification documents,

1. Sign in to Seller Central:

https://sellercentral.amazon.com

2. Open the "Account Information" tab.

3. Under "Tax Information," click "Tax Information Interview."

4. Review the available information. This includes entries such as the name in your income tax return, residential address, and tax classification.

5. Enter the tax identification number provided to you by your local tax authority.

6. In the "Upload Supporting Document" section, click "Select File" to upload a new government-issued tax document. The document must confirm your full or business name and tax identification number.

7. Give your consent by entering an electronic signature.

8. Click "Submit."

What happens if I do not upload the required documents?

If you do not provide the required documents within 10 days from this notification, disbursements for your Amazon selling account may be put on hold, or your account might be deactivated."

Could you please tell us what we should provide to Amazon, how the document looks, and where the problem comes from so we can prepare and provide these documents? We are very confused. We are asking for help if anyone has faced these issues and may guide us; we will be extremely thankful.

If you have any experience or insights on how to resolve this, kindly let me know!

Best Regards