Still being charged for VAT service after stores closed and Amazon VAT services exited

Our stores had no sales revenue and I closed the stores(no stock, no listing) two years ago.

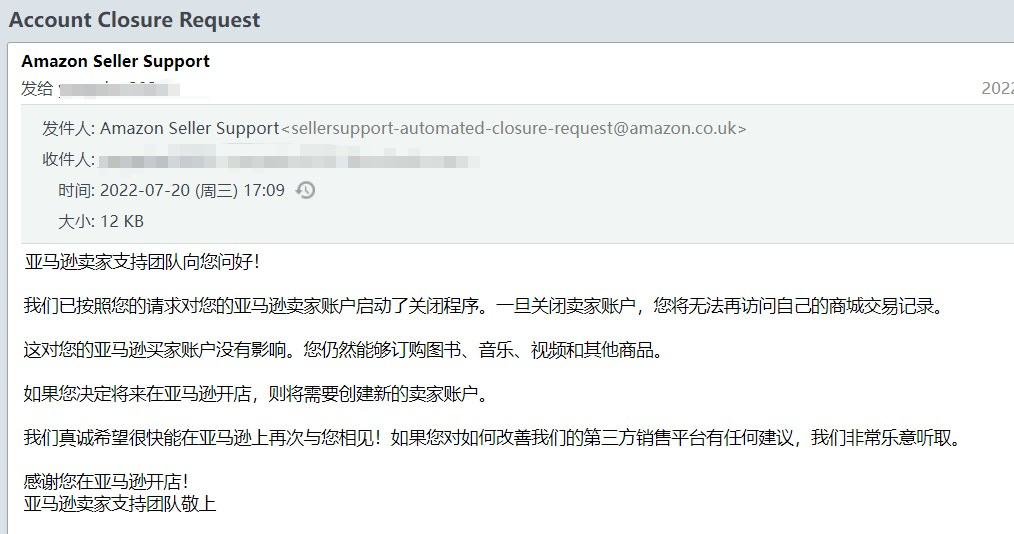

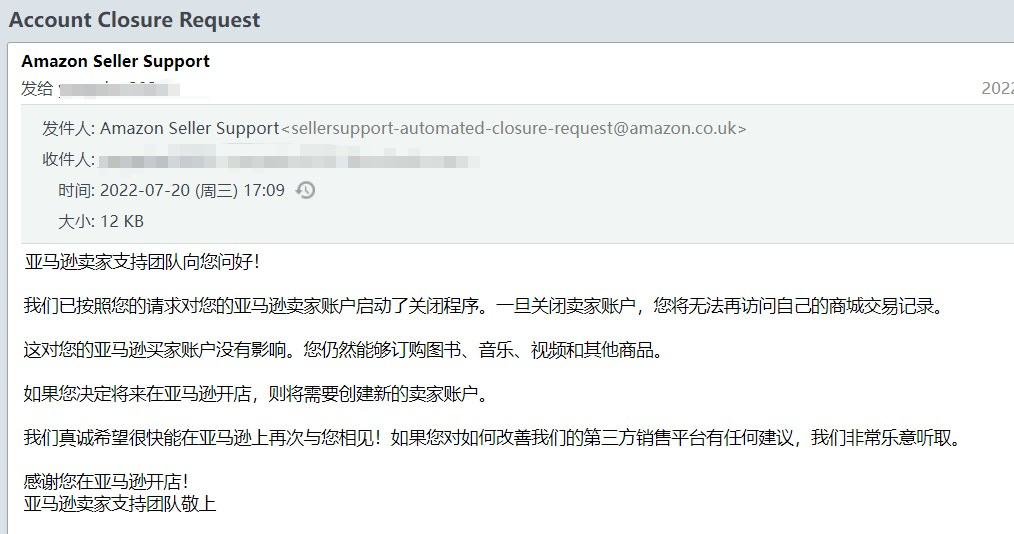

Below is the email from Amazon UK informing me that they would close my account after my request (email date July 20th, 2022).

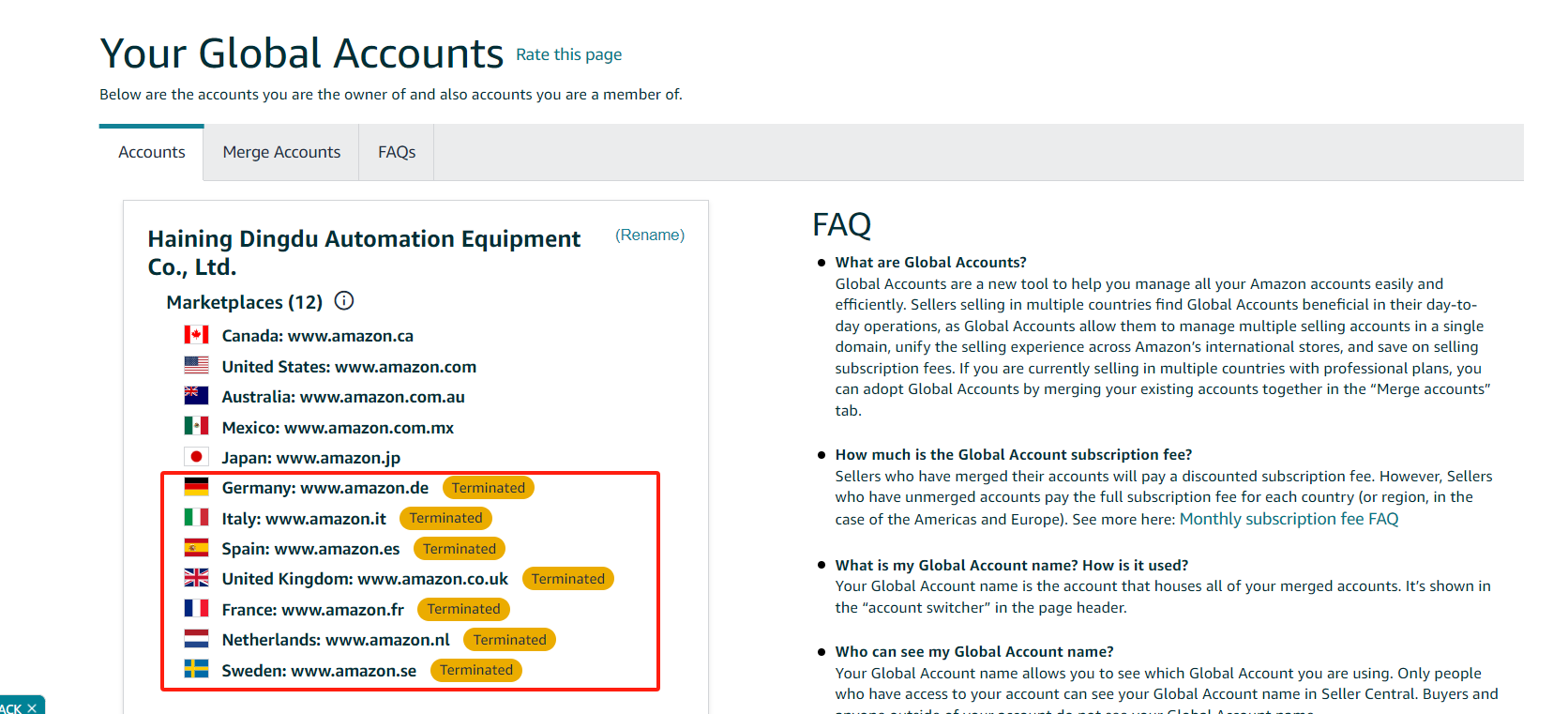

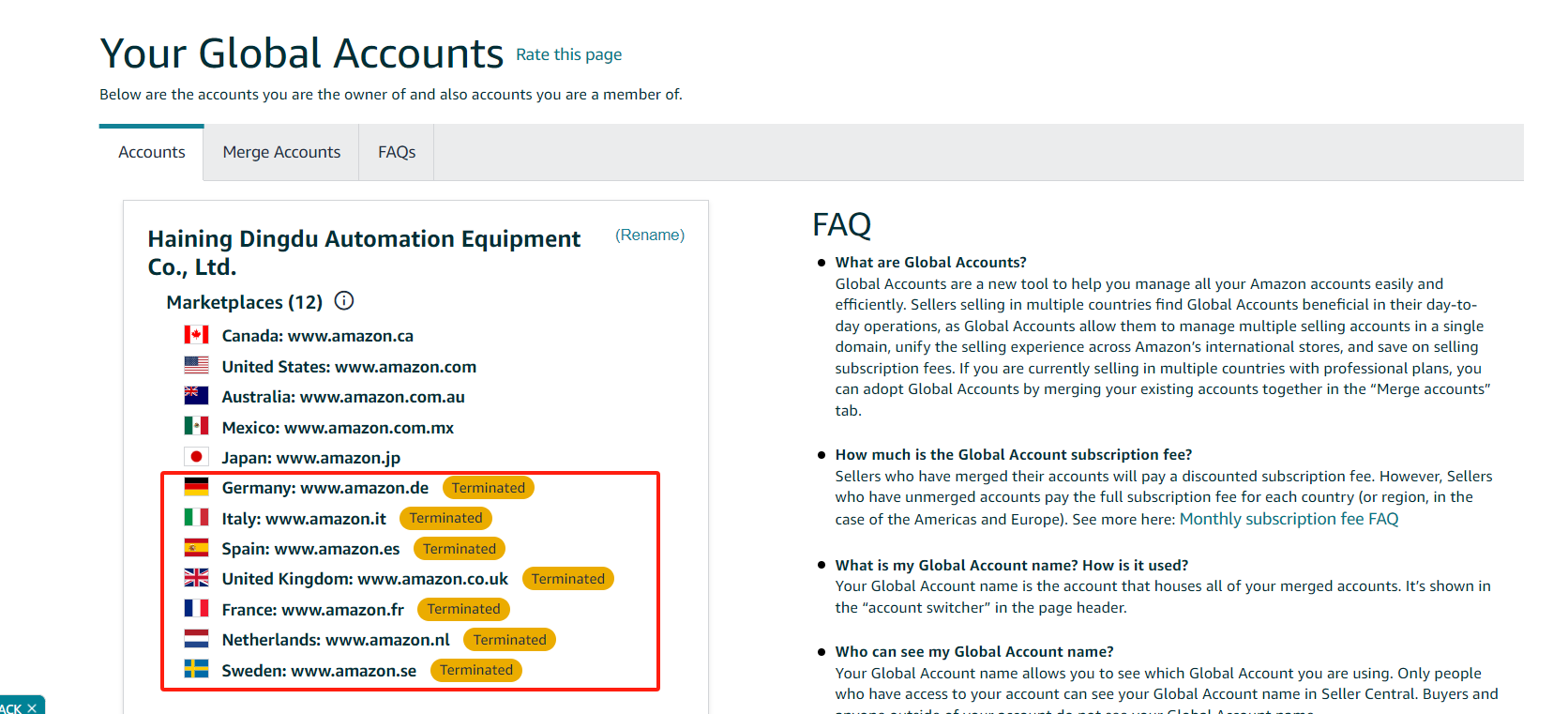

Then, the account status, UK and DE accounts are both terminated.

We thought we had closed/quit all issues. The timeline goes:

- 2022, July 20th: store closed

- 2022, July 22nd: we kept VAT number of DE, but changed the VAT agent of DE.

- 2022, August 2nd: we asked the TB account to cancel the UK VAT number and paid the cancellation charge

- 2023, September 18th: we exited Amazon VAT service (here is a delay. Because we didn't know that we still needed to exit the VAT service separately after store termination)

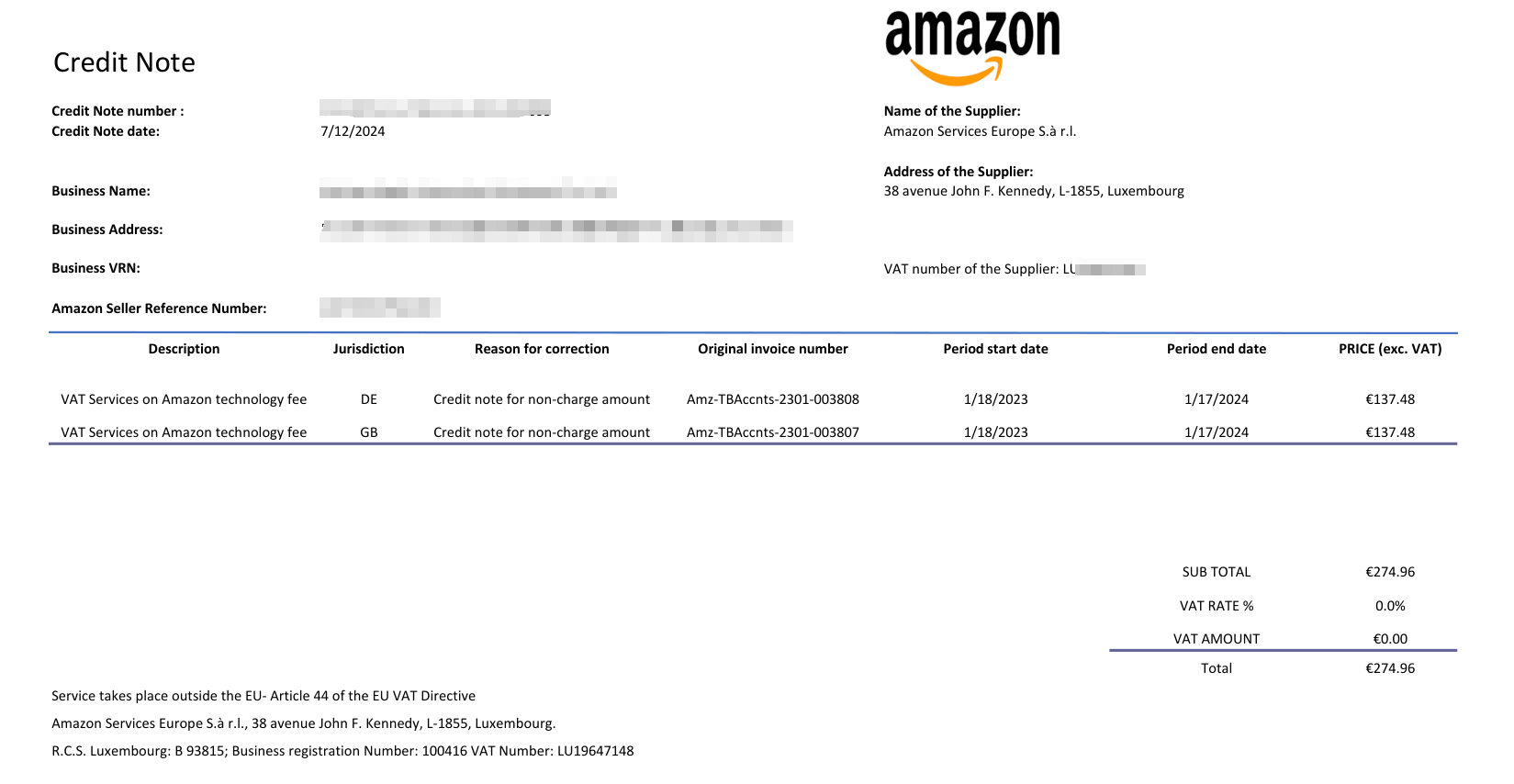

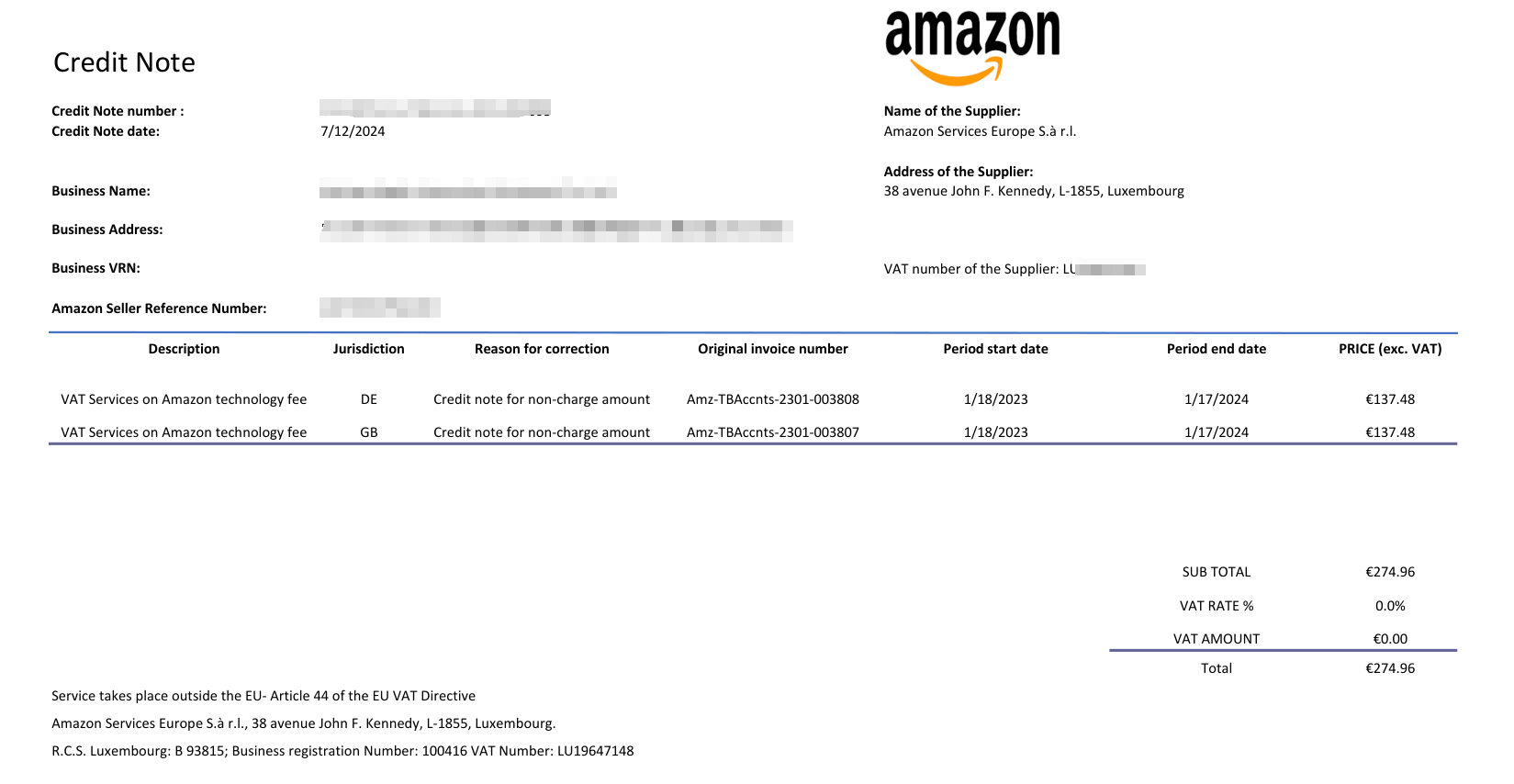

But this week, we got a bill from Amazon to pay for VAT service, €274.96, for the period Jan. 18 2023 ~ Jan. 17, 2024.

The stores were closed before the period and no services during 2023-2024 (both Amazon and TB accounts) were received. I don't think we should pay for it.

Besides, we failed to log in UK and DE stores. That is, we cannot contact the GB and DE seller support teams to issue cases in the seller central.

What can we do? Please kindly help or leave any suggestions. Thank you.

Still being charged for VAT service after stores closed and Amazon VAT services exited

Our stores had no sales revenue and I closed the stores(no stock, no listing) two years ago.

Below is the email from Amazon UK informing me that they would close my account after my request (email date July 20th, 2022).

Then, the account status, UK and DE accounts are both terminated.

We thought we had closed/quit all issues. The timeline goes:

- 2022, July 20th: store closed

- 2022, July 22nd: we kept VAT number of DE, but changed the VAT agent of DE.

- 2022, August 2nd: we asked the TB account to cancel the UK VAT number and paid the cancellation charge

- 2023, September 18th: we exited Amazon VAT service (here is a delay. Because we didn't know that we still needed to exit the VAT service separately after store termination)

But this week, we got a bill from Amazon to pay for VAT service, €274.96, for the period Jan. 18 2023 ~ Jan. 17, 2024.

The stores were closed before the period and no services during 2023-2024 (both Amazon and TB accounts) were received. I don't think we should pay for it.

Besides, we failed to log in UK and DE stores. That is, we cannot contact the GB and DE seller support teams to issue cases in the seller central.

What can we do? Please kindly help or leave any suggestions. Thank you.

0 replies

Seller_rI7BZIczK8iAC

Why don't you ask in the UK forum (change country on top right). This VAT story is really unknown to US sellers.

Connor_Amazon

Hi @Seller_baryYDXnwHHFW

Connor from Amazon here, thanks for your question.

Have you attempted to reach out to seller support? If the store is closed, you should still be able to login to create a support case as I show you active in our system. You are welcome to share the case ID with me here once you create it so that I can track it on my end.

Let me know if you have any other questions,

Connor

Seller_rI7BZIczK8iAC

BUT - that is a CREDIT NOTE, not a charge! What is it that I don't understand?