Confused pricing structure

I have a product manufacture cost £58.30

Profit mark-up 15% £8.75

total sales price excluding vat £67.05

Vat £13.41

total sales incl vat £80.45

amazon fee 13.26% on £80.45 £10.67

nett proceeds Loss -£1.93

If I increase the sales price to cover the amazon fee I end up with an increase in Vat and subsequently get a revised amazon fee

product manufacture cost £58.30

Profit mark-up 15% £8.75

Amazon fee £10.67

total sales price excluding vat £77.72

Vat £15.54

total sales incl vat £93.26

amazon fee 13.26% on £93.26 £12.37

nett proceeds Gain £7.05

My margin goes down the more I included Amazon fees

Can someone tell me where I am going wrong here??

Confused pricing structure

I have a product manufacture cost £58.30

Profit mark-up 15% £8.75

total sales price excluding vat £67.05

Vat £13.41

total sales incl vat £80.45

amazon fee 13.26% on £80.45 £10.67

nett proceeds Loss -£1.93

If I increase the sales price to cover the amazon fee I end up with an increase in Vat and subsequently get a revised amazon fee

product manufacture cost £58.30

Profit mark-up 15% £8.75

Amazon fee £10.67

total sales price excluding vat £77.72

Vat £15.54

total sales incl vat £93.26

amazon fee 13.26% on £93.26 £12.37

nett proceeds Gain £7.05

My margin goes down the more I included Amazon fees

Can someone tell me where I am going wrong here??

0 replies

Seller_ZJhFeE3tNKzfh

From that I can't quite work out what the issue is.

At your intial price point, you would have made a loss so you increase the price point but of course the amazon fees and VAT will go up as they percentage based not fixed.

Seller_QuM1AZgzfU9x4

In the 2nd example you're adding the Amazon fee onto the selling price and then deducting the amazon fee from that total.

In reality that £10.67 doesn't exist and has been mentioned the fees are a percentage of selling price.

Seller_IC5dxZRZpcM4T

Hi,

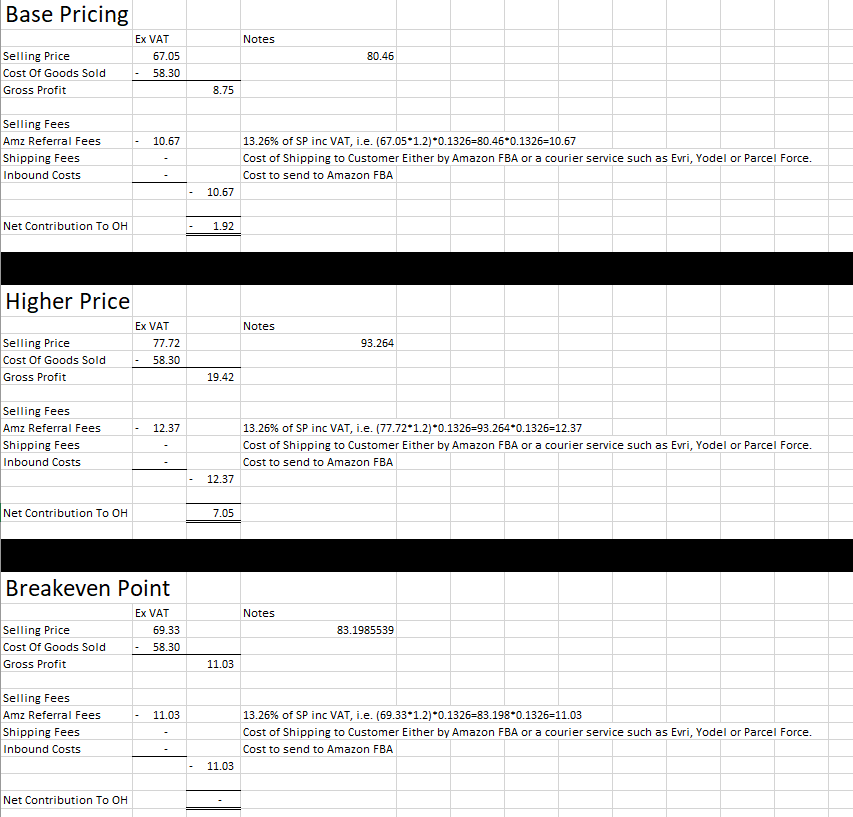

Ive changed the example into a format that should make more sense, although I do have some reservations.

You don't appear to have any shipping costs included. If this is a digital product then I wouldn't expect any shipping costs, however as you refer to Manufacturing cost I assume this is a tangible product.

I have put in the example both of your examples and also the breakeven model assuming zero shipping costs, maybe the customer is collecting the item from you.

You should also include a small cost for shipping the product into Amazon if it is an FBA sale.

Wheat I haven't included is ancillary items supplied by Amazon as an option extra such as storage costs and bubble wrap, and other packaging supplied.

Hope this helps.

M@