VAT Enquiry UK

Hello guys,

I've tryed before to get an answer , but no luck . I will try one more time.

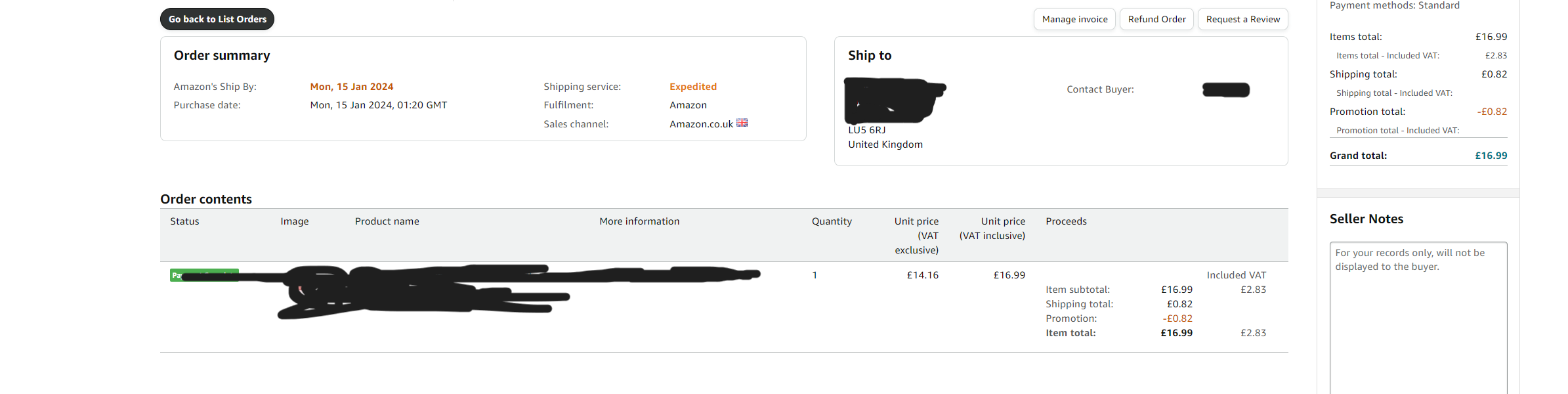

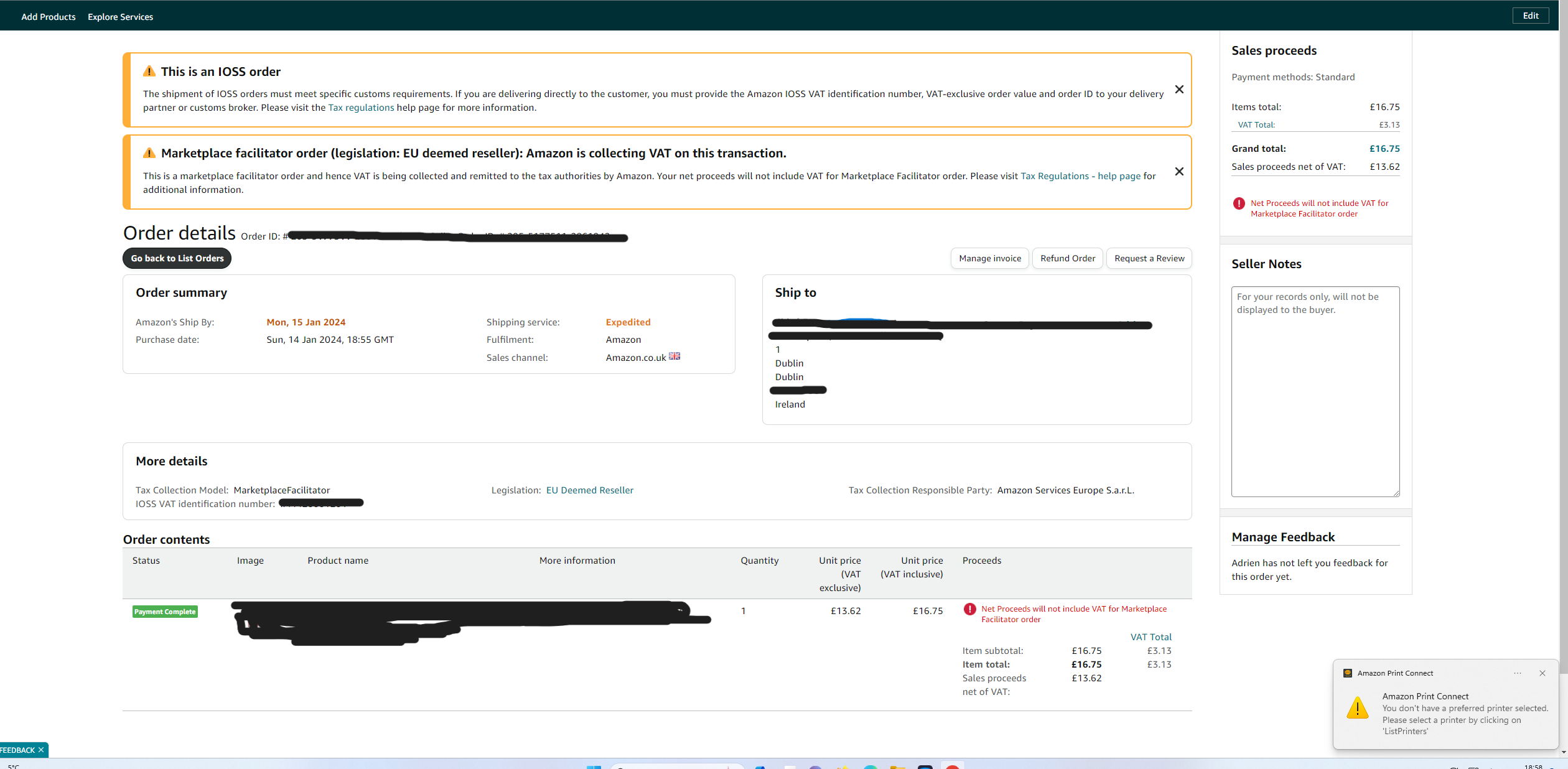

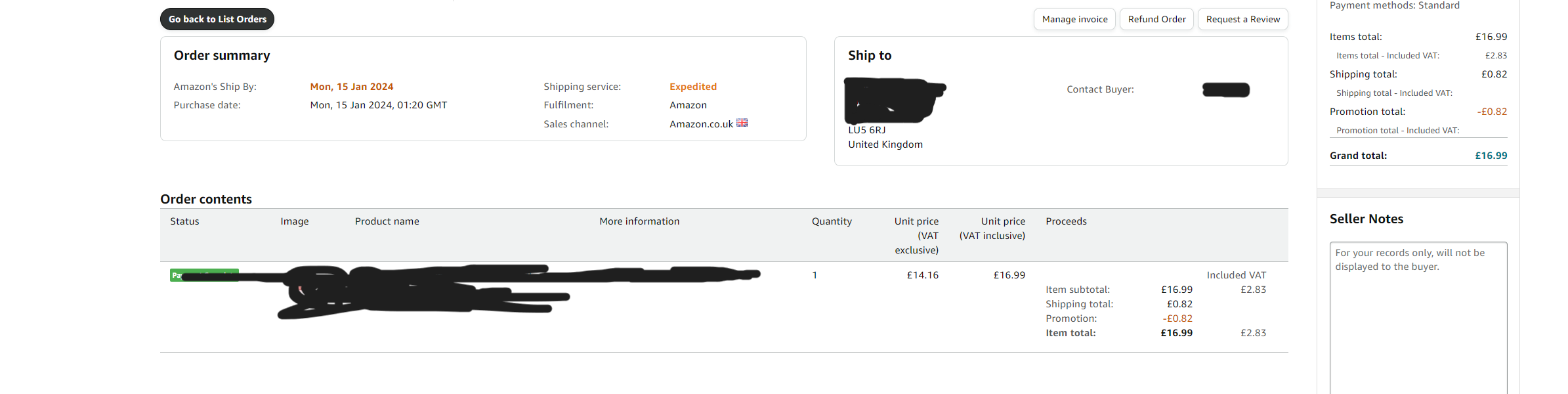

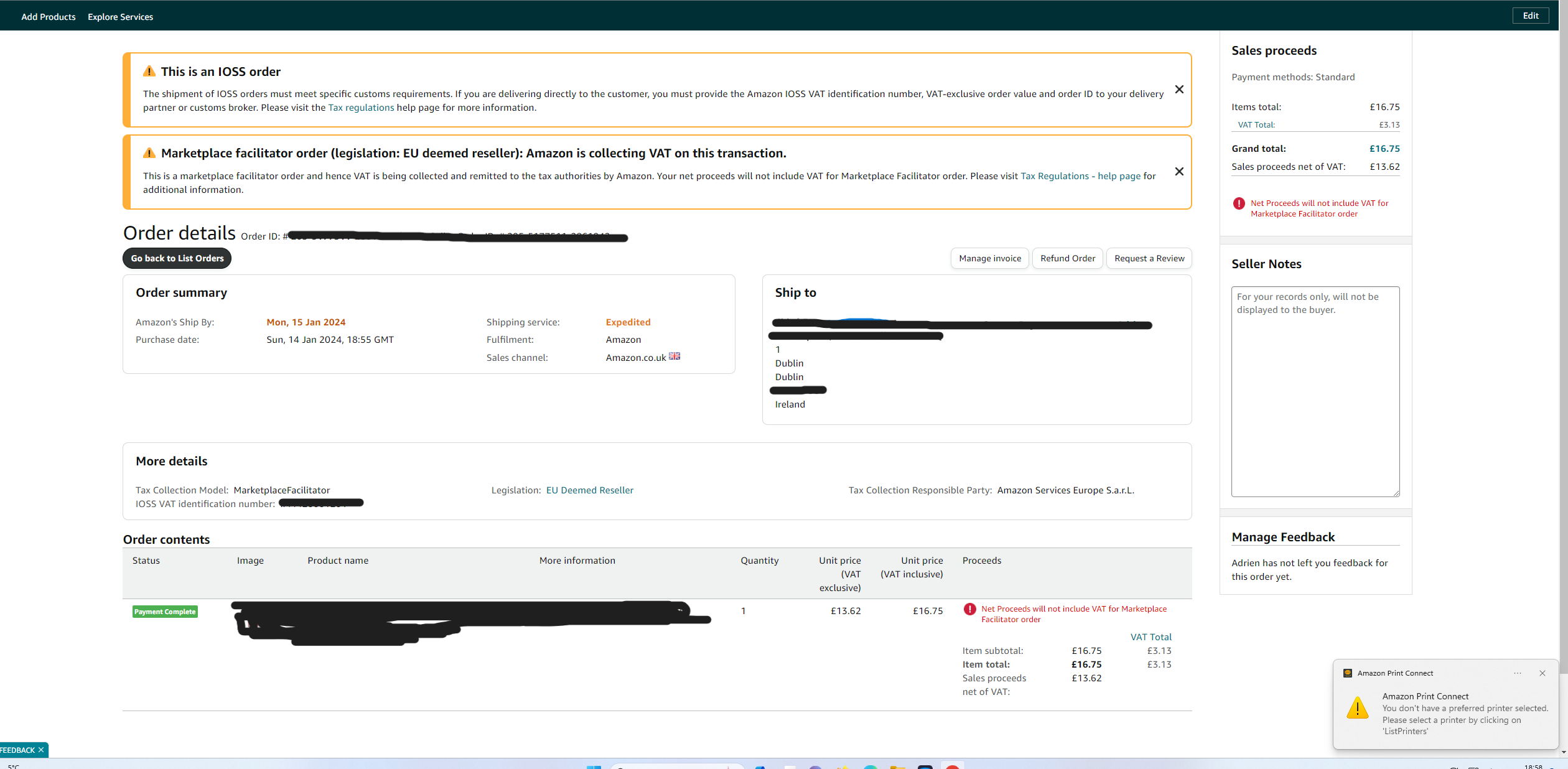

I am doing FBA in UK. Everything fine untill i am selling in Ireland where they stopping me the VAT. Please check the printscreens.

WHat i wanna ask is what documents/reports do i need to download to reflect the VAT already paid ?

Please someone help me .

VAT Enquiry UK

Hello guys,

I've tryed before to get an answer , but no luck . I will try one more time.

I am doing FBA in UK. Everything fine untill i am selling in Ireland where they stopping me the VAT. Please check the printscreens.

WHat i wanna ask is what documents/reports do i need to download to reflect the VAT already paid ?

Please someone help me .

0 replies

Seller_RlZVPg3d6ZUGP

This is right, just when you do your VAT return you separate it out from your UK sales

Simon_Amazon

Hello @Seller_Xm8ysIIu8mESs,

Here Simon from Amazon.

Have you already checked the Amazon VAT Transactions Report (AVTR)?

Please let me know if you are able to find the information you are looking for.

Otherwise, please don't hesitate to reach out.

Best,

Simon