VAT calculation services suddenly deactivated & vat number rejected after several years of use

I've had my vat number enrolled in vat calculation services for several years and it's suddenly been rejected. I only sell in the UK via FBA.

I've also received an email advising the following:

''You have automatically been removed from the VAT Calculation Service (VCS) as you no longer meet the following VCS eligibility criteria:

Your default country for VAT exclusive price must have a valid EU VAT number.''

Have Amazon changed their vat calculation services eligible criteria so that you can only use them if you have an EU vat number? Has anyone else had the same thing happen and if so, have you managed to resolve it?

Any help much appreciated. Thank you.

VAT calculation services suddenly deactivated & vat number rejected after several years of use

I've had my vat number enrolled in vat calculation services for several years and it's suddenly been rejected. I only sell in the UK via FBA.

I've also received an email advising the following:

''You have automatically been removed from the VAT Calculation Service (VCS) as you no longer meet the following VCS eligibility criteria:

Your default country for VAT exclusive price must have a valid EU VAT number.''

Have Amazon changed their vat calculation services eligible criteria so that you can only use them if you have an EU vat number? Has anyone else had the same thing happen and if so, have you managed to resolve it?

Any help much appreciated. Thank you.

0 replies

Seller_RqW6qUPpjbkL3

Did you get this resolved as i have the same issue

Seller_hf3WAIwfSX840

We have been to and frow with the vat-number-appeals@amazon.com team, it as a total joke.

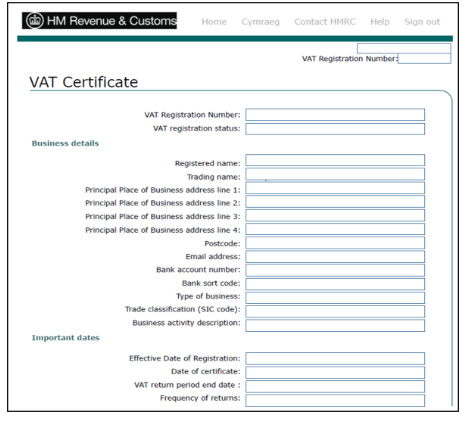

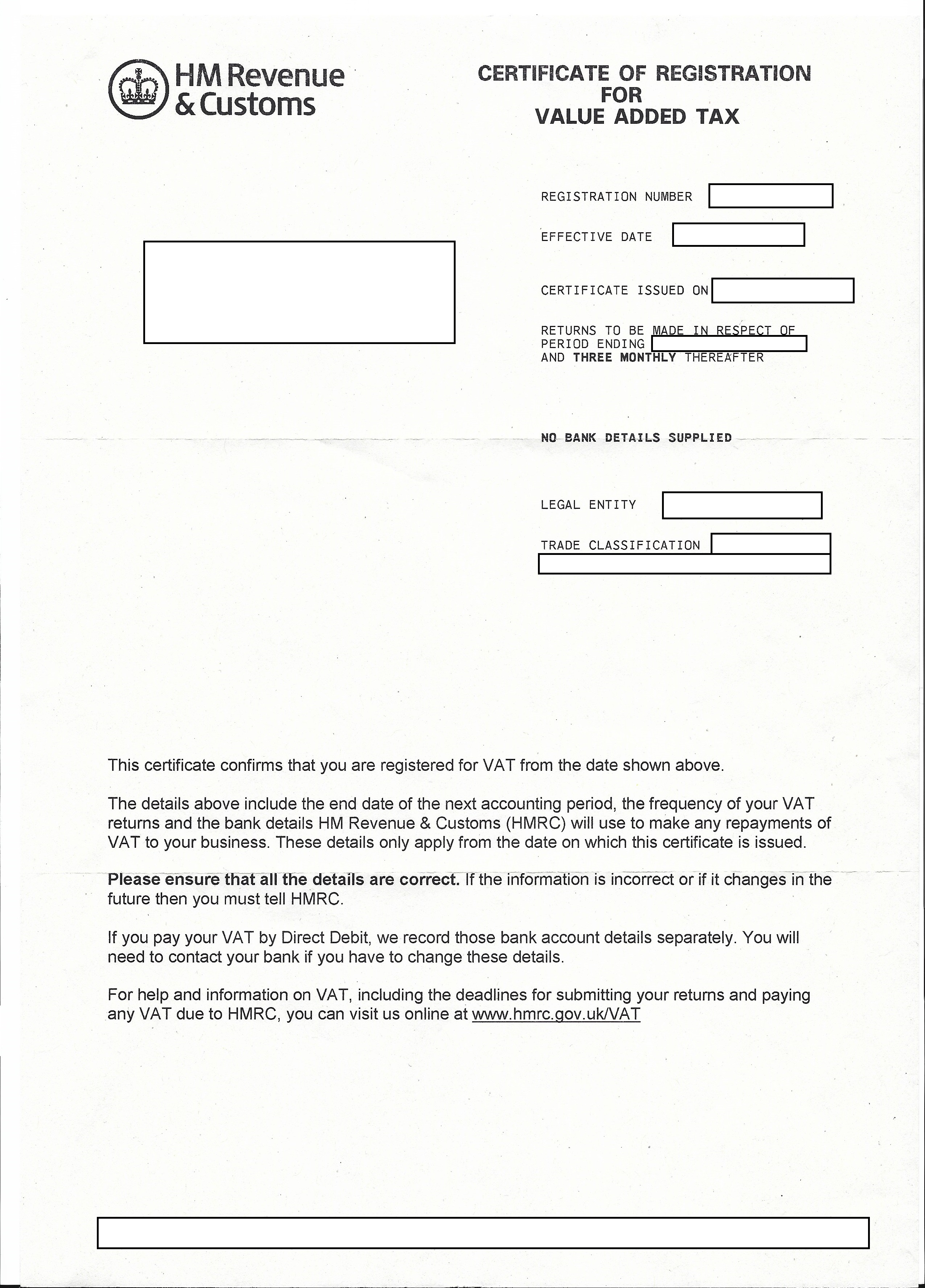

They are saying that our VAT certificate is not acceptable, we downloaded it directly from the HMRC wevsite but guess what, they keep saying that we have in some way edited it, I pointed out that that would be a criminal offence but of course AMAZON are an entity upon this planet, they clearly do not understand the implications of their incompitence on this matter.

I was told that I had to upload one of the two documents I have attached but HMRC do not have an option to download either.

I think that Amazon will be asking us all to pay for this service (the reason for this) in the future. I mean its very very difficult for Amazon to have these documents available for the buyers, simple programming.