VAT CHARGE

VAT CHARGE

0 replies

Seller_76AUwmqvSyRIM

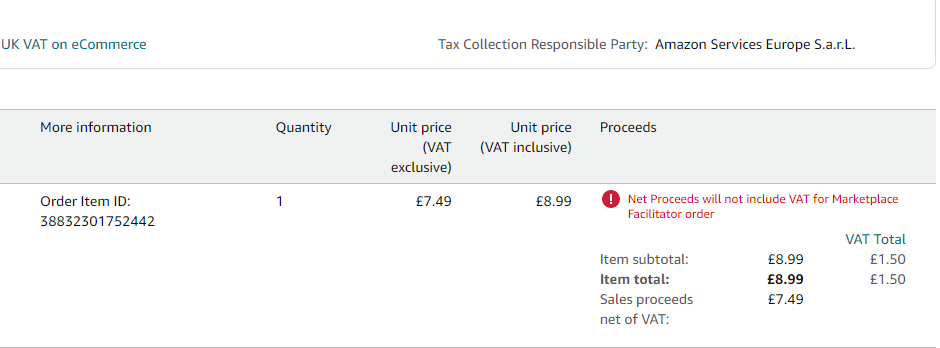

Unfortunately, Amazon don't know how to treat Irish orders and they deduct UK VAT from the payout even for non-VAT registered companies.

All you can do is to write to Seller Support and ask them to repay you the missing £1.50. It will take approximately 20 ping-pongs while they explain the regulations to you, ignoring the fact that they do not apply to you.

It's a right pig's dinner.

Or you can simply switch off Ireland sales and forget about the £1.50.

Good luck, I feel for you.

Simon_Amazon

Hello @Seller_9iHK4SvKWNz28,

Here Simon from Amazon, happy to try to help.

Have you tried to reach out to Seller Support as @Seller_76AUwmqvSyRIM suggested?

Open question to the other Sellers on the Forums: Are you also impacted by this?

-Simon