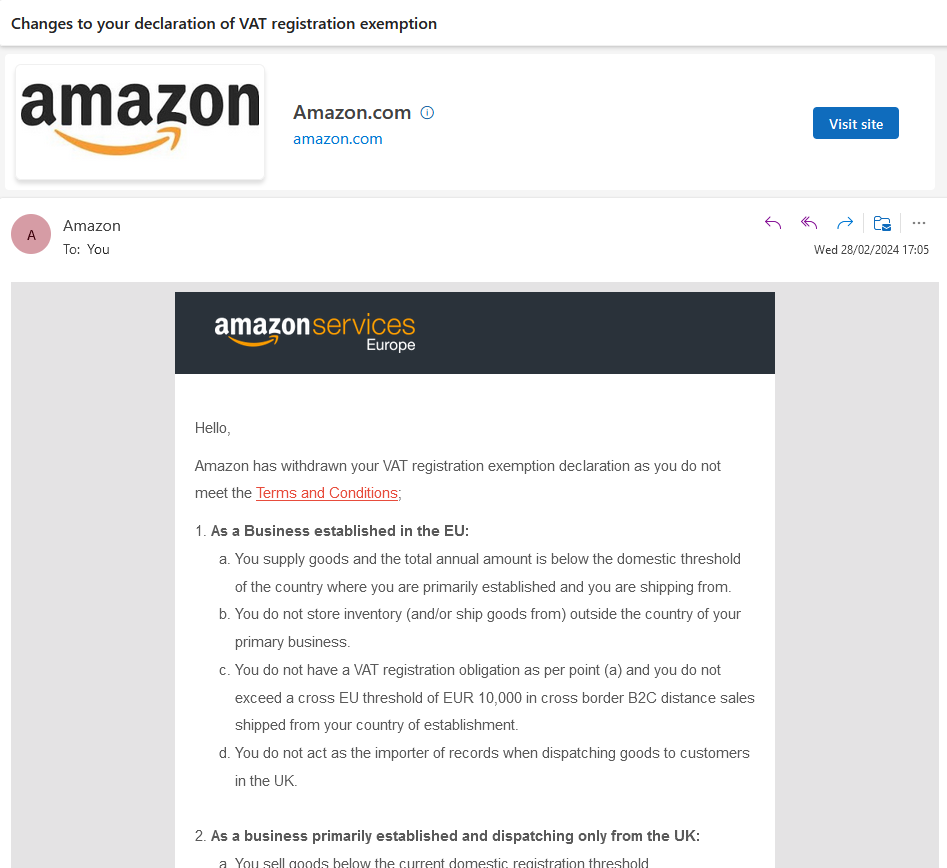

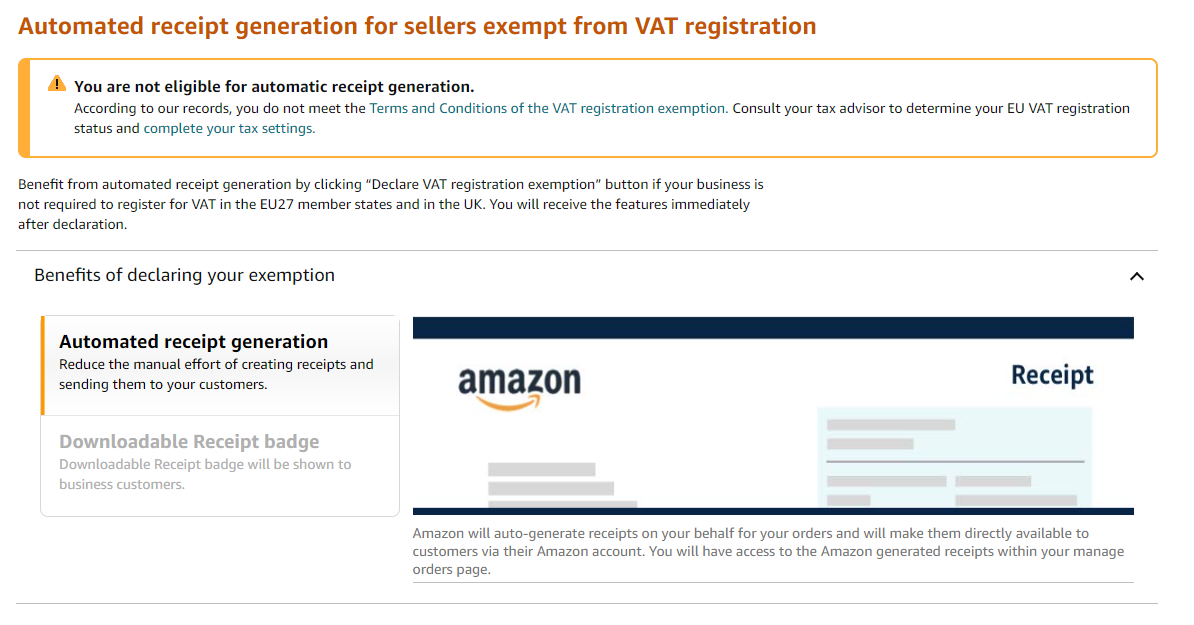

Amazon has withdrawn your VAT registration exemption declaration as you do not meet

Hi,

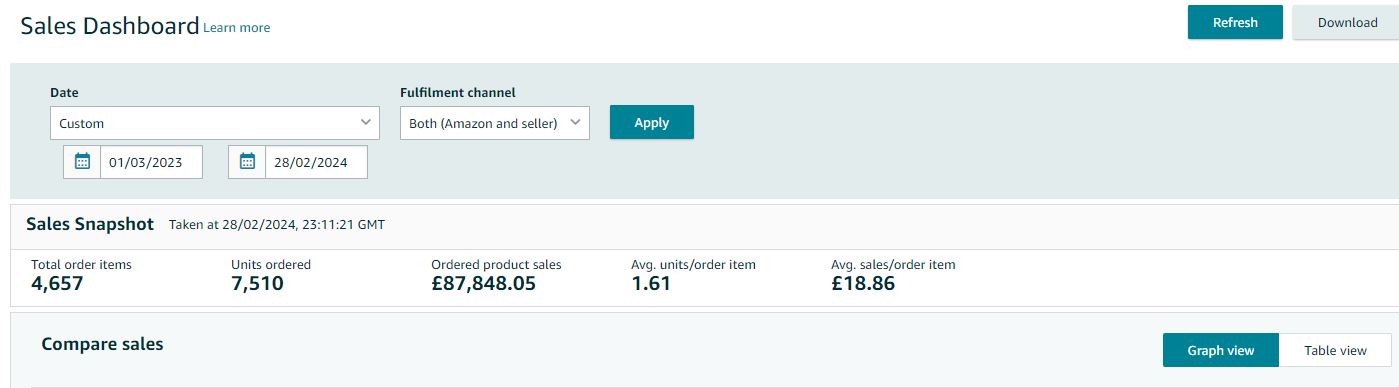

I was trading as sole trader until turnover 83k then i registered a limited company and transferred the seller account Sole trader to limited. Today i have received email Amazon has withdrawn your VAT registration exemption declaration. My company is just two weeks old, According to HMRC if you are moved from sole trader to limited before 85k, VAT threshold will be reset.

As my company is two weeks old and not done business of over 85k. but amazon shows 12 months turnover over 85k, including 83k when i was sole traders.

Do i need to VAT registered? please help.

Amazon has withdrawn your VAT registration exemption declaration as you do not meet

Hi,

I was trading as sole trader until turnover 83k then i registered a limited company and transferred the seller account Sole trader to limited. Today i have received email Amazon has withdrawn your VAT registration exemption declaration. My company is just two weeks old, According to HMRC if you are moved from sole trader to limited before 85k, VAT threshold will be reset.

As my company is two weeks old and not done business of over 85k. but amazon shows 12 months turnover over 85k, including 83k when i was sole traders.

Do i need to VAT registered? please help.

13 replies

Seller_RlZVPg3d6ZUGP

if you did £83k as a sole trader did you add on the VAT from the fees that youve saved by being exempted? could that have taken you over the £85k? If so, you should have been VAT registered as a sole trader before you changed

Also, it normally takes a while to change sole trader to ltd is your account fully verified and changed over?

Seller_RlZVPg3d6ZUGP

So if you claim VAT exemption you have to add the VAT part of your fees to your turnover calculation

Seller_ZVAz3d5lZuGid

Quote: It was total 83k sales

VAT is based on turnover, not sales profit, so as said, you have to add the VAT on fees into it.

Seller_reoHzCcrHZ6jW

i do believe, i am below the threshold.

Seller_RlZVPg3d6ZUGP

So when you become VAT registered you reverse charge the VAT on fees on your VAT return,

When you are VAT exempted you add the VAT on the fees to your turnover

You need to go through it with an Amazon experienced accountant

Do you sell elsewhere too?

Seller_reoHzCcrHZ6jW

i am not taking any chance with amazon, i just have sent VAT registration application.

Seller_UImKvM8RwScxb

Yes, you need to be VAT registered - the transfer of the Sole Trader into Ltd is a TOGC and you need to take your previous turnover into account. If you expect to go over the threshold then you needed to register for VAT. Lots of misinformation on these tiktok groups saying that the VAT turnover resets. If it did then everyone would just flip between sole trader to ltd and back.