[URGENT] Update your business address to match tax records

I have received an email this morning, with title as per above

"We have noticed a discrepancy between the business address you have provided in Seller Central and the information in the tax records for your VAT Registration Number (VRN)"

I have checked both addresses and they are identical, apart from the way that Amazon chooses to order the business address details which is backwards i.e. country, Post Code, Town, Street.

We have 7 days to correct it, but I have absolutely no idea what I need to correct.

Why would Amazon alert me now about information that was required during verification? Surely it wouldn't have passed that process at the time, now over 2 years ago.

I will try to contact Sales Support, but I'm not confident they will understand.

@Jessica_Amazon_ could you or other moderators point me in the right direction?

I would appreciate any guidance.

174 replies

Seller_dl5O35GVF6pBt

I thought this was SPAM and ignored it for a few days, however its been on my mind so I read these comments so I have phoned seller central and they walked me through mine. I had errors which I never would have thought - I have completed step by step on the phone and submitted for verification for the team to check it. It is a genuine email please call amazon CS and they can help tell what needs to be changed. hope this helps others

Seller_CJAn9FclIoBJn

We have had to reverify off the back of this which has been a nightmare (again).

Twice this year....and a VAT farce earlier in the year.

Check your statements page/disbursements ours is a mess. Since the 17th most funds are being tagged as deferred payments and do not show in account level reserve.

Not released until the 25th onwards which funnily enough was the date given to amend any account descrepencies...

The hard thing on Amazon is not being 'shot in the head' by Amazon for no reason you can fathom. They really hate the people who sell on here - they have to? Or it has to be a massive wind up??

Cannot trust the account balance now. Had funds held before now but not just do not exist (except for the brief scary moment when a disbursement is paid and the screen is basically blank....)

Seller_d8YGbIjNqwFxn

@Simon_Amazon do you have any updates on this.

It would be good to have an answer to what (if anything) we need to do before the weekend.

Ready stories about sellers who do change information and then having issues with payments is very worrying so really don't want to do anything unless it is absolutely essential.

Would also like guidance of what happens on the 25th if Amazon deem the addresses still do not match. Is it suspension, removal of VAT number etc

Seller_4mvpF14wacAyg

My company address has "England" in it and my tax address has "GB".

I'm not taking any risks, I'm updating the tax address to say "England".

Coming into Q4 can't afford Amazon doing random things to my account...

Seller_PAoOCZ5pKszVP

got this as well, has caused a bit of panic here, I checked the addresses and they look the same, nothing has changed in the 3+ years of trading. What has caused this email and are Amazon going to send an update email either explaining exactly what I need to do, or just say it was an error and just ignore it? not ideal given the tone of the email and the limited period to fix it.

Sarah_Amzn

Hello @Seller_AeNP16b2BeNI9 @Seller_IfSV5eBt32Mxj @Seller_pfmAG3Qx211yJ @Seller_bdSdLjti4IugQ @Seller_d8Jy8m7vsJ9bJ @Seller_5eABuaPEcMuug @Seller_wji8wgzhAH8ra @Seller_Nprc5XWvdLYk9 @Seller_ZeJVFnhmOkMdm @Seller_VpTps3nNkV8hZ @Seller_7Gzk2DXnerEBv @Seller_ubORE22IPnaRQ @Seller_yCmhAScU7oxMw @Seller_AqX6aDdqTl6Ty @Seller_Y9fFZ8oEs17ES @Seller_9A54I8WeWrwx0 @Seller_Qrqi3Gr1D0qyY @Seller_nwChNrxV8nh8q @Seller_d8YGbIjNqwFxn @Seller_lavthw0xwEbsk @Seller_dl5O35GVF6pBt @Seller_dtDzb0clEI627 @Seller_SpHSX1raAIk97 @Seller_CJAn9FclIoBJn @Seller_4mvpF14wacAyg @Seller_PAoOCZ5pKszVP

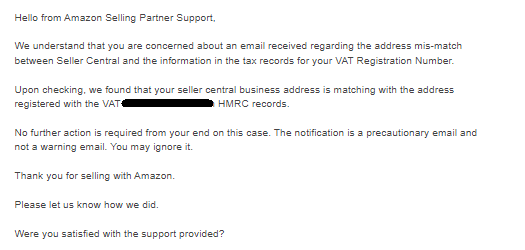

After consulting with the partner team, I'm sharing with you their communication:

"We can confirm that the email “[URGENT] Update your business address to match tax records” was sent by our team. The email was intended to remind you to check that your business address in Seller Central and the information in the tax records for your VAT Registration Number (VRN) match by September 25 so that you can continue to use Amazon’s invoicing services. If your information already matches, there is no further action required. Beyond the use of certain Amazon invoicing services, there is no other impact to your account. We sincerely apologize for the confusion caused and are investigating internally to improve the clarity of future communications."

Please don´t hesitate to contact me if you have any additional questions or concerns.

Kind regards,

Sarah.

Seller_dtDzb0clEI627

Does anyone know if the VAT address has to match the ‘registered’ address of the (limited) company?

Our company is registered to our accountants which is a different address to the VAT registered address.

I am wondering if I need to change the registered business address (with HMRC) to the same as the VAT address.

I’m really confused with all this talk of “matching” addresses. What we have is a common setup that a lot of limited companies do.

Thanks

Seller_GWpMgZr4kgude

We have three addresses. The account office is in Luton, but the operation office is in Manchester. Warehouse is in Middleton.

Seller_AVteysPitiEJq

I opened a case and was told to do nothing and that the internal teams are working on it.

If you're worried, ask SS to check if you do need to do anything as I'm out of VAT and the VAT number in the email doesn't even exist anymore so how did they know my details are different with HMRC?

Seller_CJAn9FclIoBJn

We have had a reponse from SS regarding our query over this and funds which are all deferred.

I received the following feedback from the disbursements team:

A technical issue on September 17th-19th has caused the bank account re-verification on selling accounts. A reserve was applied to all affected accounts for security purposes while the technical problem was being resolved.

Your disbursements are in normal status now, and your bank account details are verified successfully.

The above is not the case - we are verified but all funds are going into a deferred payments section - zero in account level reserve and this has been the case since the 17th. Basically we have had no new funds since the 17th. Amazon has not got a clue what is going on - thats become obvious. The above is about the 3rd reason we have been given form the hiccup that appeared on the 17th.

The saga continues.